FirstEnergy Set to Report Q1 2025 Earnings with Positive Growth Outlook

FirstEnergy Corp. (FE), with a market capitalization of $23.4 billion, specializes in generating, distributing, and transmitting electricity. The company, based in Akron, Ohio, operates through several segments, including Distribution, Integrated, and Stand-Alone Transmission. Investors are anticipating FirstEnergy’s first-quarter earnings report for 2025, which is expected to be released after the market closes on Wednesday, April 23.

Analysts forecast that FirstEnergy will post adjusted earnings of $0.58 per share, representing a growth of 5.5% compared to the $0.55 per share reported in the same quarter last year. The company has shown a mixed performance in the last four quarters, meeting or exceeding the Street’s bottom-line estimates twice but falling short on two occasions.

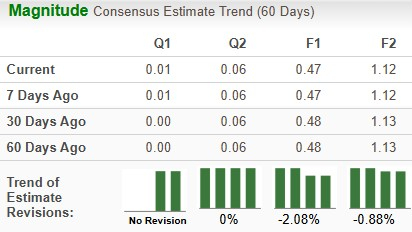

For the fiscal year 2025, projections indicate that FirstEnergy will report an adjusted EPS of $2.68, reflecting a 1.9% increase from $2.63 in fiscal 2024. Looking towards fiscal 2026, earnings are expected to grow further, with a forecast of $2.93, which represents a year-over-year increase of 9.3%.

Over the past year, FE shares have achieved a gain of 7.9%, outperforming the S&P 500 Index, which rose by 3.2%. However, FE has underperformed compared to the Utilities Select Sector SPDR Fund (XLU), which surged by 17.9% during the same period.

The stock stumbled nearly 10.5% following the release of its weaker-than-expected fourth-quarter results on February 26. FirstEnergy reported Q4 revenue of $3.2 billion, which missed analyst expectations of $3.7 billion. Although the Integrated segment benefitted from new base rates and reduced operating expenses, comparable earnings of $0.67 per share lagged the forecast of $0.70.

Looking ahead, FirstEnergy anticipates that its adjusted EPS will range between $2.40 and $2.60 for fiscal 2025, signifying an approximate 5.5% year-over-year growth at the midpoint. Additionally, the company targets a long-term EPS growth rate of 6% to 8%, backed by a substantial $28 billion capital investment plan for the years 2025 to 2029.

Overall, analysts maintain a moderately optimistic outlook on FirstEnergy, assigning a “Moderate Buy” rating. Among 16 analysts covering the stock, six recommend a “Strong Buy,” one suggests a “Moderate Buy,” eight rate it as a “Hold,” and one advises a “Moderate Sell.” The consensus mean price target stands at $43.78, indicating a 7.8% premium over current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For further information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.