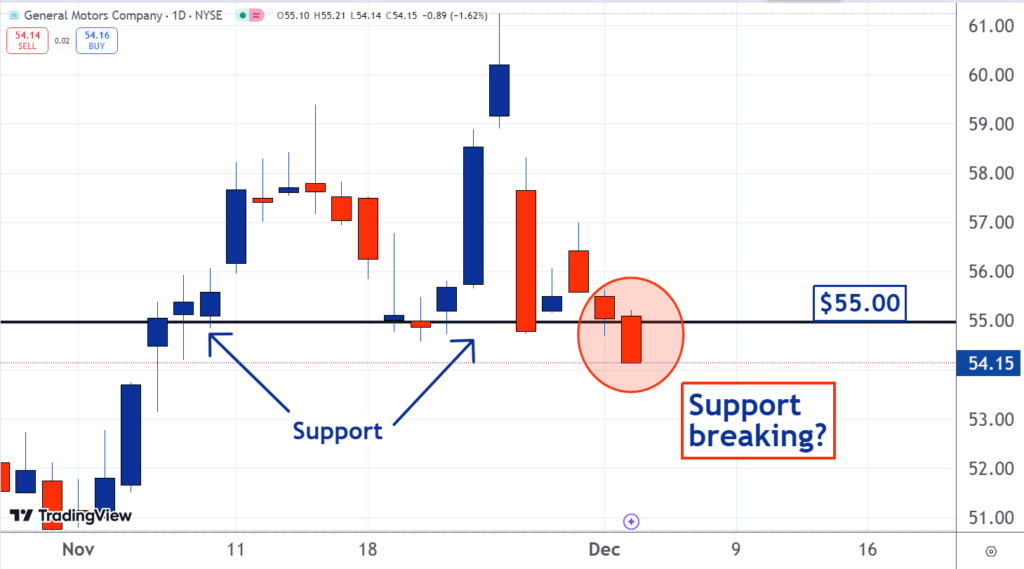

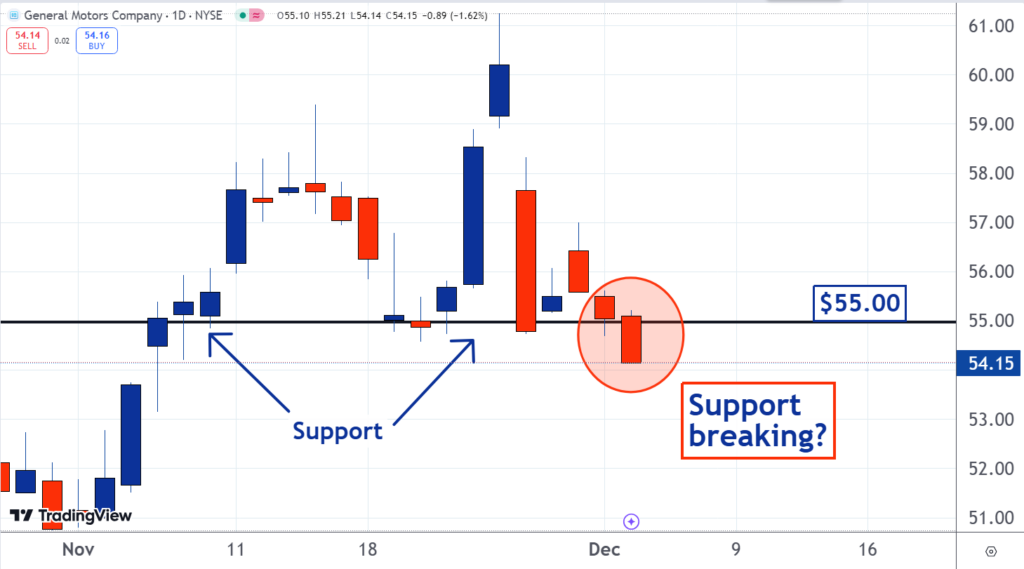

General Motors Faces Breaking Support in Today’s MarketGM shares are trading lower on Tuesday, suggesting they may be breaking a critical support level.

When stocks break support levels, they often continue to decline. This situation has prompted our team of technical analysts to pick General Motors as our Stock of the Day.

Some analysts may overlook the fundamentals of technical analysis. They focus on chart patterns without grasping the underlying price movements that lead to these formations.

At its core, technical analysis examines supply and demand within the market.

For a stock that is falling, lack of demand means there are not enough buy orders to meet the volume of sell orders. Consequently, sellers must lower their prices to attract buyers.

This scenario drives the stock into a downtrend.

However, when a stock reaches a support level, the dynamics change. At that point, enough demand exists to absorb all available supply, allowing sellers to avoid pushing prices lower.

Related Reading: Trump’s Tariff Plan Risks Economic Pain For North America, Goldman Sachs Warns

As illustrated in the chart, the $55 level has served as a significant support for General Motors since early November. Unfortunately, this support appears to be eroding.

When a stock trades below a previously established support level, it is said to have “broken” that support. This change is more than just a technical detail; it reflects a significant market condition.

It indicates that the investors who created that support by placing buy orders are no longer active. They have either completed their trades or canceled their orders and exited the market.

With many buy orders gone, the potential now exists for a new downtrend to take shape. To attract buyers back into the market, sellers may need to lower their prices further.

Thus, it becomes common for stocks to decline following a break of support. General Motors may be on the brink of forming a new downtrend.

Up Next:

• GM To Sell Stake In Michigan Battery Plant To JV Partner For Nearly $1B

Photo: Shutterstock

Overview Rating:

Promising

Market News and Data brought to you by Benzinga APIs