General Motors Set to Report Q1 2025 Results on April 29

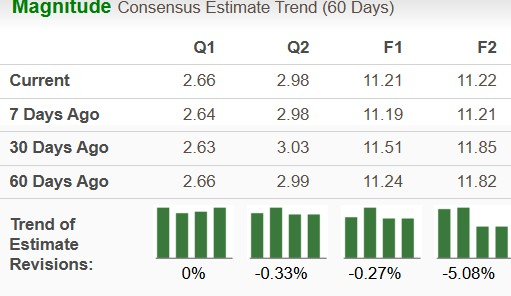

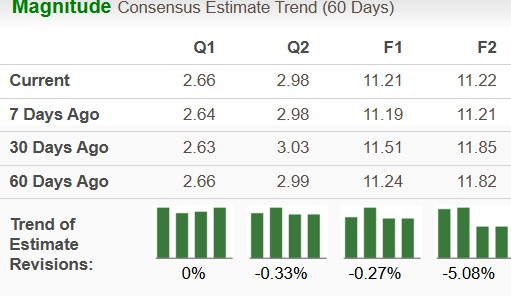

General Motors (GM) is expected to announce its first-quarter 2025 results on April 29, prior to the market opening. The Zacks Consensus Estimate projects earnings per share (EPS) of $2.66 and revenues of $42.37 billion for the upcoming quarter.

Over the past week, the consensus estimate for GM’s earnings has increased by 2 cents. This figure represents a modest year-over-year growth of 1.5%, while the revenue estimate indicates a slight decline of 1.5% compared to the same period last year.

For the full year 2025, analysts have estimated GM’s revenues at $179.3 billion, reflecting a 4.3% decrease year over year. In contrast, the projected EPS for 2025 stands at $11.21, which indicates an approximate 6% increase from the prior year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In the last four quarters, GM, a legacy automaker in the U.S., exceeded earnings estimates each time, achieving an average earnings surprise of 15.81%.

General Motors Company Price and EPS Surprise

General Motors Company price-eps-surprise | General Motors Company Quote

Q1 Earnings Predictions for GM

Our analysis suggests that GM is likely to beat earnings expectations this quarter. The company has an earnings ESP (earnings surprise prediction) of +7.40% and holds a Zacks Rank of #3 (Hold). This combination typically indicates favorable odds for an earnings surprise.

(Refer to the Zacks earnings calendar for significant upcoming market announcements.)

Key Factors Influencing General Motors’ Q1 Results

In the first quarter of 2025, GM sold 693,363 vehicles, reflecting a 17% increase year over year. The company achieved double-digit growth across its major brands: Chevrolet (up 13.7%), GMC (up 17.6%), Cadillac (up 17.8%), and Buick (up 39.3%). GM led total, retail, and fleet sales in the U.S., while its closest competitor, Ford (F), experienced a 1.3% decrease in sales during the same period.

Notably, GM’s retail sales rose by 15%, marking the strongest first-quarter performance since 2018. Electric vehicle (EV) sales surged by 94%, totaling 31,887 units, establishing GM as the second-largest EV seller in the U.S., behind Tesla (TSLA).

During the upcoming quarter, GM delivered 442,000 vehicles in China, showing minimal change year over year but a 26.3% decline from the previous quarter. Despite this, sales of new energy vehicles increased by 53.2% compared to the previous year. The Buick GL8 led the premium multi-purpose vehicle segment with 24,000 units sold, and the Wuling Hong Guang MINIEV remained popular, alongside notable gains from the LaCrosse and Envision Plus models. Additionally, Chevrolet Tahoe deliveries commenced under GM’s Durant Guild platform in March.

Our expectations for wholesale vehicle sales in the General Motors North America (GMNA) segment are set at 807,000 units, reflecting a year-over-year increase of 1.9%. We project revenues from GMNA to reach $36.46 billion, indicating a 1% increase, with an estimated operating income of $3.9 billion, denoting 2% growth.

Conversely, wholesale volumes from the General Motors International (GMI) unit, excluding the China joint venture, are anticipated to decline by approximately 2% to 102,000 units. Year-over-year revenue from this unit is expected to contract by 17%, though we predict an operating income of $58.3 million, a significant recovery from a loss of $10 million in the previous year.

GM’s Price Performance and Valuation

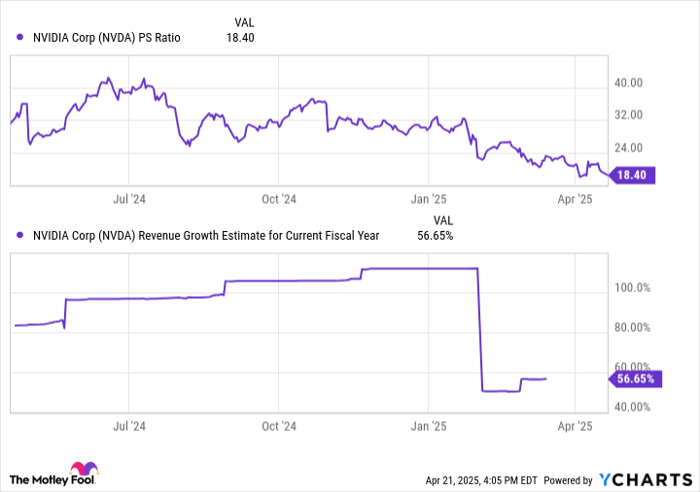

So far in 2025, General Motors shares have decreased by 12%, but this downturn is less than the broader auto sector’s performance. GM has also outperformed Tesla, whose shares have dropped 36% this year, while Ford’s stock has experienced a modest increase of 1.6%.

Year-to-Date Price Performance Comparison

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

From a valuation standpoint, General Motors is currently trading at a forward price-to-sales (P/S) ratio of 0.26, significantly lower than the industry average of 2.19. The company holds a Value Score of A, while Tesla is viewed as relatively expensive at a forward P/S of 7.6, and Ford is slightly lower than GM at 0.24.

GM’s P/S Compared to Ford and Tesla

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Investment Outlook for General Motors Ahead of Q1 Earnings

As the leading automaker in the U.S., General Motors is making significant progress in its electrification strategy.

GM closed out 2024 with strong performance indicators, including a positive variable profit margin for its EV portfolio. The company produced 189,000 electric vehicles last year with ambitions to reach 300,000 units in 2025. Expectations show EV losses could decline by $2 billion this year, thanks to improved operational efficiencies and scale. Furthermore, GM successfully achieved a $2 billion cost-reduction target and aims to identify another $1 billion in savings through reduced investments in robotaxi developments.

In China, GM’s operations are beginning to show promise. The company’s restructuring strategies in the region appear to be yielding initial signs of recovery, with goals aimed at returning to profitability.

GM Ends 2024 Strong, Faces Short-Term Challenges Ahead

General Motors (GM) showcased robust financial strength by concluding 2024 with a solid automotive liquidity of $35.5 billion. In addition, the automaker returned $7.6 billion to shareholders, a gesture that reflects confidence in its long-term strategy. This included a notable 25% increase in dividends and a new $6 billion stock repurchase authorization, which comprises a $2 billion accelerated share repurchase (ASR).

Short-Term Headwinds and Forecast Challenges

Despite these positive indicators, GM is confronted with potential headwinds in the near future. The company anticipates a small decline in volumes for internal combustion engine vehicles in North America. Moreover, GM projects a 1-1.5% decrease in vehicle pricing, which may negatively impact profit margins. Additionally, uncertainties around macroeconomic factors and ongoing tariff issues could affect the company’s near-term outlook.

Long-Term Outlook Encourages Caution for New Investors

While GM presents as a compelling long-term investment, new investors might consider adopting a cautious approach. It may be prudent to remain on the sidelines until GM clarifies its strategies for managing the current tariff pressures and pricing challenges. Exercising patience before purchasing GM stock is advisable, as the market waits for more transparency regarding the company’s future performance.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.