“`html

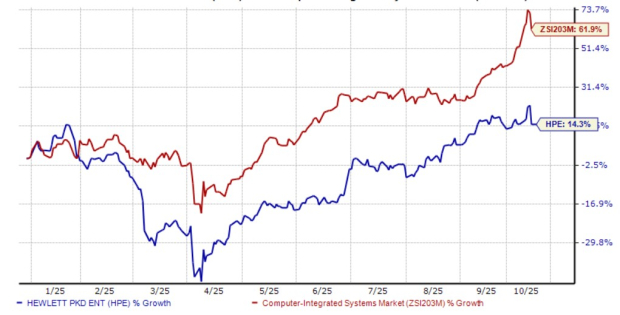

Hewlett Packard Enterprise (HPE) has seen a year-to-date stock price increase of 14.3% but lags behind the Zacks Computer – Integrated Systems industry, which boasts a return of 61.9% during the same period. The company’s forward price-to-sales ratio stands at 0.81, significantly lower than the industry average of 3.59, marking its current stock as undervalued.

In the third quarter of fiscal 2025, HPE’s Hybrid Cloud segment grew 14.2% year over year, driven by the adoption of its Alletra MP arrays, and the GreenLake platform gained 2,000 new users, totaling 44,000 customers. HPE’s recent acquisition of Juniper Networks, completed on July 2, 2025, resulted in a 54.3% rise in its new Networking segment’s revenue, reaching $1.73 billion.

Despite these gains, HPE faces challenges such as a potential decline in IT spending due to economic pressures. The company competes with major industry players including IBM, Dell, and Microsoft, which may impact its market share and revenue generation.

“`