J.B. Hunt Transport Services Faces Challenges Despite Strong Q3 Earnings

Stock Performance Subpar Compared to Broader Market

Headquartered in Lowell, Arkansas, J.B. Hunt Transport Services, Inc. (JBHT) stands out as a major player in supply chain solutions, boasting a market capitalization of $19.2 billion. Known for its cutting-edge transportation and logistics strategies, the company provides various services, such as intermodal, dedicated, truckload, and final mile delivery.

Stocks Struggle While Rivals Thrive

Over the past year, shares of JBHT have notably underperformed the wider market. The stock climbed 5.9%, contrasting sharply with the S&P 500 Index ($SPX), which surged nearly 31.8%. In 2024, JBHT is down 4.7%, while the SPX has increased by 25.8% year-to-date.

Further analysis reveals that JBHT also trailed the Industrial Select Sector SPDR Fund (XLI), which gained 35.4% over the past year and 25.6% year-to-date.

Impressive Q3 Results Boost Stock

On October 15, JBHT released its Q3 earnings report, causing shares to rise by 3.2% in the following trading session. The company reported earnings of $1.49 per share, exceeding Wall Street’s expectations of $1.42. Additionally, revenue came in at $3.07 billion, surpassing analysts’ forecasts of $3.04 billion.

Mixed Earnings Predictions Ahead

Looking ahead to the current fiscal year, which ends in December, analysts project an 18.2% decline in JBHT’s earnings per share (EPS) to $5.70 on a diluted basis. The company’s earnings history presents a mixed bag; it missed the consensus estimate in three of the last four quarters, achieving a beat only once.

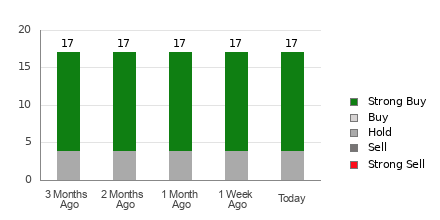

Of the 21 analysts covering JBHT, the consensus rating is a “Moderate Buy.” This includes 13 “Strong Buy” ratings, one “Moderate Buy,” and seven “Holds.”

Analysts Adjust Price Targets Amid Mixed Outlook

This consensus is less positive than it was two months ago, when 12 analysts rated the stock as a “Strong Buy.”

On November 12, Citigroup Inc. (C) analyst Ariel Rosa increased the price target on JBHT from $204 to $227, while keeping a “Buy” rating. The firm noted a more positive sentiment for North American transport stocks, despite the mixed Q3 earnings and cautious outlooks for Q4. However, Citi raised concerns that investors might be pursuing stocks that have already appreciated significantly, which would necessitate outperformance to validate current valuations.

The average price target stands at $191.40, offering a slight premium compared to JBHT’s current price. The highest price target of $220 suggests an upside potential of 15.6% for the stock.

On the date of publication, Kritika Sarmah did not hold (either directly or indirectly) any positions in any securities mentioned in this article. All information and data in this article are for informational purposes only. For more information, please refer to the Barchart Disclosure Policy here.

The views and opinions expressed in this article represent those of the author and do not necessarily reflect the views of Nasdaq, Inc.