Keurig Dr Pepper Struggles Amid Market Challenges

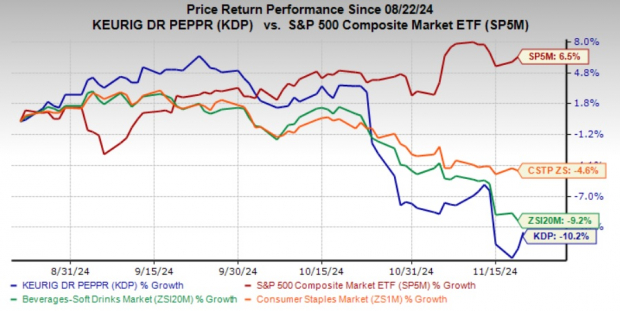

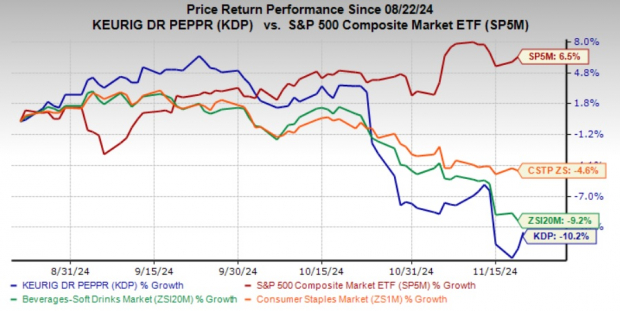

Keurig Dr Pepper Inc. (KDP) shares have dropped 10.2% in the last three months, falling short of the Zacks Beverages – Soft Drinks industry’s 9.2% decline. The company also underperformed the broader Consumer Staples sector, which declined by 4.7%, and the S&P 500, which gained 6.5% during the same period. KDP closed at $32.04 yesterday, remaining below its 50-day and 200-day simple moving averages (SMA) of $35.4 and $33.52, respectively. This trend indicates a potential ongoing downturn.

Image Source: Zacks Investment Research

Challenges in the Coffee Market Pressuring KDP

Keurig Dr Pepper is facing difficulties in its coffee segment, reflecting wider challenges in the at-home coffee market, which affected third-quarter earnings. Sales in the U.S. Coffee segment dropped by 3.6% year-over-year, primarily due to a net price decline of 6.3%, though a volume/mix improvement of 2.7% offered some relief.

Looking ahead, management anticipates that trends for at-home coffee will remain weak, despite bolstering pod shipments. The outlook for 2024 suggests a continuation of these muted trends.

Additionally, KDP’s decision to acquire GHOST Beverages, an energy drink company, has met with skepticism from investors. The acquisition involves a $990 million investment for a 60% stake, with plans to secure the remaining 40% by 2028 at an unspecified price.

Keurig Dr Pepper is also facing pressure from certain still beverage categories, which are suffering due to overall consumer spending softness. Categories like ready-to-drink teas, which depend on convenience store sales, are experiencing significant challenges.

KDP’s Path Forward Amid Struggles

Despite these challenges, KDP’s brand strength and increased volume contributed positively to its third-quarter performance. The company’s focus on innovation, monitored through scorecards that track awareness and loyalty, has helped it gain market share in key categories such as liquid refreshment beverages, K-Cup pods, and brewers across the U.S., Mexico, and Canada.

This growth is indicative of a strategic blend of innovation, brand activity, and strong execution, alongside KDP’s commitment to cost efficiency and disciplined capital management. In the third quarter, the company finalized the purchase and integration of new assets in Arizona that began in the previous quarter.

Keurig Dr Pepper has recorded steady growth in its Refreshment Beverages segment, which improved significantly year-over-year in Q3 2024. This progress is attributed to higher pricing and a strong product mix, underscored by successful sales across major product lines and the effective transition of Electrolit.

The Dr Pepper brand has been a key driver for growth in the carbonated soft drink category, thanks to the popularity of its creamy coconut summer flavor, expanded zero-sugar options, and the ongoing Fansville football campaign. Similarly, Canada Dry’s new Fruit Splash flavor, refreshed branding for 7UP, and Shirley Temple flavor have garnered social media attention. Additionally, the Mott’s brand saw success from its back-to-school marketing campaign, enhancing sales and market share.

A Cautious Outlook for KDP

Keurig Dr Pepper’s stock has struggled recently, showing underperformance compared to industry peers. The combination of technical weaknesses and fundamental challenges suggests that investors should proceed with caution. While the company is grappling with significant issues, particularly in its coffee and still beverage segments, its strengths in refreshment beverages and consumer-focused innovations may provide some balance. Current investors may find it wise to hold onto KDP stock, which currently holds a Zacks Rank #3 (Hold).

Looking for Strong Alternatives?

In the broader Consumer Staples market, consider better-ranked stocks such as Ingredion (INGR), Freshpet, Inc. (FRPT), and Vita Coco Company (COCO).

Ingredion specializes in nature-based sweeteners and nutrition ingredients, currently holding a Zacks Rank #1 (Strong Buy). The company has seen an average earnings surprise of 9.5% over the last four quarters. Its earnings per share (EPS) for the current financial year is projected to grow by 12.5% compared to last year.

Freshpet, known for its natural fresh meals and treats for pets, has a Zacks Rank of 2 (Buy). The company achieved an impressive 144.5% earnings surprise last quarter, with expectations for a 27.3% increase in sales and a 224.3% rise in earnings this year.

Vita Coco, which markets coconut water products globally, also holds a Zacks Rank of 2 and has experienced an average earnings surprise of 17.6% over the last four quarters. The projected growth for COCO’s sales and earnings this year stands at 3.5% and 29.7%, respectively.

Top Stock Pick to Watch

A recent analysis from Zacks investment experts reveals a standout stock anticipated to potentially double in value. Among thousands of stocks, the Director of Research, Sheraz Mian, highlighted one notable pick targeting millennial and Gen Z audiences, boasting nearly $1 billion in revenue last quarter. Following a recent dip, this stock may be worth considering. Past successes, such as Nano-X Imaging, which surged by 129.6% in just over nine months, also suggest potential within this selection.

For a closer look at today’s top stock picks, download the report featuring “5 Stocks Set to Double.”

Vita Coco Company, Inc. (COCO): Free Stock Analysis Report

Freshpet, Inc. (FRPT): Free Stock Analysis Report

Ingredion Incorporated (INGR): Free Stock Analysis Report

Keurig Dr Pepper, Inc (KDP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.