Kimco Realty: A Solid Player in a Competitive Market

Kimco Realty Corporation (KIM), located in New York, is a prominent real estate investment trust (REIT) with a market cap of $16.6 billion. The company specializes in owning and managing open-air, grocery-anchored shopping centers across North America, while also broadening its collection of mixed-use properties.

Performance Overview: Keeping Pace Amidst Market Variability

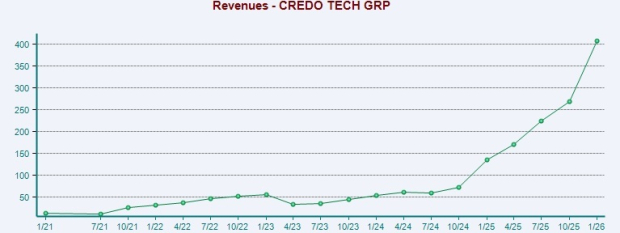

Over the past year, this leading REIT has slightly lagged behind the broader market trends. KIM has increased 31% over the last 52 weeks, whereas the S&P 500 Index ($SPX) saw returns of 35.8% in the same period. However, KIM has made strides in 2024, matching the S&P 500’s year-to-date gains of 24.3%.

In more granular terms, KIM has also underperformed relative to the JPMorgan Realty Income ETF (JPRE), which has returned 24% over the past year and 9.6% year-to-date.

Earnings Report: Promising Numbers Despite Share Drop

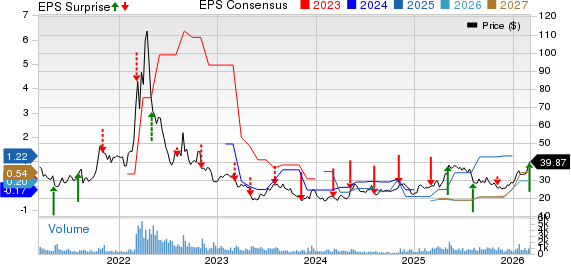

On October 31, Kimco reported its Q3 earnings. Despite surpassing analysts’ expectations for both revenue and earnings, the stock dipped 1.3%. During this quarter, the company achieved a record high for pro-rata small shop occupancy at 91.8%.

For its fiscal year ending in December, analysts predict that Kimco Realty’s funds from operations (FFO) per share will grow by 3.8% year over year to reach $1.63. Historically, the company has a track record of meeting or exceeding the consensus FFO estimates for the past four quarters.

Analyst Consensus: A Balanced Outlook

Among the 22 analysts covering KIM stock, the consensus rating stands at “Moderate Buy,” based on nine “Strong Buy” ratings and 13 “Holds.” This marks a shift from two months ago when 10 analysts assigned a “Strong Buy” rating.

On November 1, Evercore Inc. (EVR) analyst Steve Sakwa reiterated a “Hold” rating for Kimco Realty, setting a price target of $24. The average price target of $24.55 suggests a slight premium compared to current pricing, while the highest target of $29 indicates a potential upside of 19.2%.

More Stock Market News from Barchart

On the date of publication, Kritika Sarmah did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data provided are strictly for informational purposes. For additional details, please refer to the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.