McKesson Corporation: Navigating Challenges with Resilient Growth

With a market cap of $76.6 billion, McKesson Corporation (MCK) stands out as a major player in healthcare services and information technology, based in Irving, Texas. The company operates worldwide across four main segments: U.S. Pharmaceutical, Prescription Technology Solutions (RxTS), Medical-Surgical Solutions, and International.

McKesson, classified as a “large-cap” stock due to its worth exceeding $10 billion, provides essential services to healthcare providers, pharmacies, pharmaceutical manufacturers, and patients. Its mission focuses on enhancing healthcare outcomes through innovative solutions and robust logistics support.

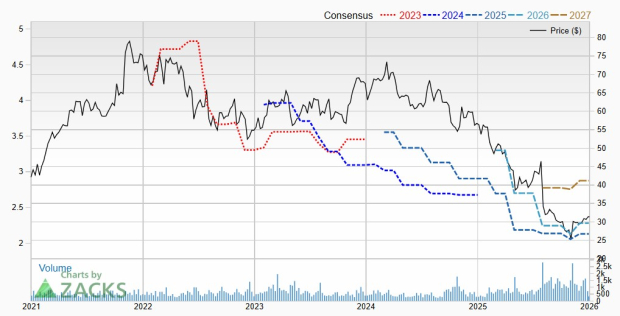

Recently, MCK shares experienced a 5.3% decline from their 52-week high of $637.51 reached on August 2. Despite this dip, shares have gained 16.6% over the past three months, although this performance trails the broader Nasdaq Composite’s ($NASX) 17.6% increase during the same period.

Over a longer timeline, MCK stock has increased by 28.3% year-to-date (YTD), which falls short of the NASX’s 32.3% growth. Additionally, MCK has shown a 29.7% increase over the past year, compared to NASX’s 37.9% returns.

Encouragingly, MCK has been trading above its 50-day moving average since mid-October and has also maintained levels above its 200-day moving average since early November, indicating a potential bullish trend.

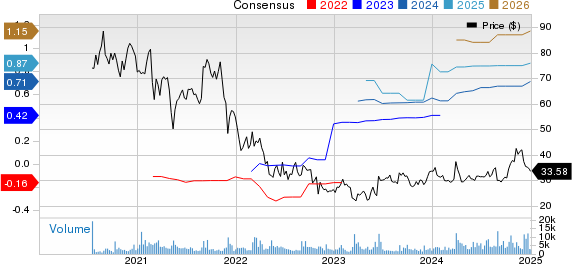

A significant 10.6% surge in McKesson’s shares followed the company’s Q2 earnings release on November 6, driven by financial results that surpassed analyst expectations. McKesson reported an adjusted earnings per share (EPS) of $7.07 and revenues of $93.7 billion. This robust performance was largely attributed to growth in the U.S. Pharmaceutical segment, especially in specialty products and GLP-1 medications, alongside contributions from Prescription Technology Solutions and Medical-Surgical Solutions. The company also raised its fiscal 2025 adjusted EPS guidance to a range of $32.40 – $33, boosting investor confidence further.

In comparison, MCK has outperformed its competitor Cencora, Inc. (COR), whose shares rose 20% over the past year and 17.9% YTD.

Even though MCK has not kept pace with the Nasdaq’s gains over the last year, analysts remain optimistic, granting the stock a consensus rating of “Strong Buy” from 16 analysts. The average price target of $662.47 indicates a potential upside of 11.1% from its current price.

On the date of publication, Sohini Mondal did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data provided are strictly for informational purposes. For more details, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.