Molson Coors Performance: Analyzing Recent Trends and Market Position

Molson Coors Beverage Company (TAP), based in Golden, Colorado, engages in the manufacturing, marketing, and selling of beer and malt beverage products across a range of brand names. The company has a market capitalization of $12.3 billion. Its extensive operations include markets in the Americas, Europe, the Middle East, Africa, and the Indo-Pacific region.

With a valuation above $10 billion, Molson Coors is categorized as a “large-cap” stock, signifying its significant presence and influence within the brewing industry. Its brand portfolio comprises well-known names such as Aspall Cider, Blue Moon, Coors Original, Hop Valley, and Leinenkugel’s.

Active Investor: FREE newsletter going behind the headlines on the hottest stocks to uncover new trade ideas.

Molson Coors reached its 52-week peak of $69.18 on April 9, 2024, but is currently trading 12% below this high. Over the past three months, the stock has increased by 5.3%, which is a strong performance compared to the Dow Jones Industrial Average, which has seen a decline of 2.3% in the same period.

In the longer term, Molson Coors has shown mixed results. Over the past six months, its stock price rose by 7.1%. However, it has depreciated by 9.5% over the past year, while the Dow experienced a slight decline of 0.74% during the same six-month period but achieved a gain of 5.5% over the last year.

Recent trading indicates a positive trend. Molson has remained consistently above its 50-day and 200-day moving averages since mid-February.

After releasing its better-than-expected Q4 results on February 13, Molson’s stock prices surged by 9.5%. The company reported a 6.4% year-over-year decline in volumes, impacted by currency challenges. However, a pricing and sales mix improvement of 4.5% helped counteract this decline. Consequently, net sales dropped 2% year-over-year to $2.7 billion, yet this figure exceeded analysts’ expectations by roughly 1%. Favorable pricing led to a gross margin improvement of 91 basis points to 37.9%, while gross profits rose slightly to $1.04 billion. Additionally, its adjusted earnings per share (EPS) surged 9.2% year-over-year to $1.30, surpassing consensus estimates by 15%, thus bolstering investor confidence.

Notably, Molson Coors has significantly outperformed Constellation Brands, Inc. (STZ), which has faced a 29% decline over the past six months and a 32.5% drop over the last year.

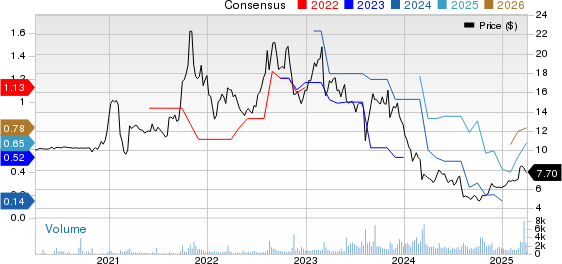

Among the 20 analysts covering TAP, the consensus rating is a “Moderate Buy.” The average price target is set at $65.25, indicating a 7.2% potential upside from current trading levels.

On the date of publication, Aditya Sarawgi did not hold positions in any of the mentioned securities. All information provided is for informational purposes only. For more information, please view the Barchart Disclosure Policy here.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.