“`html

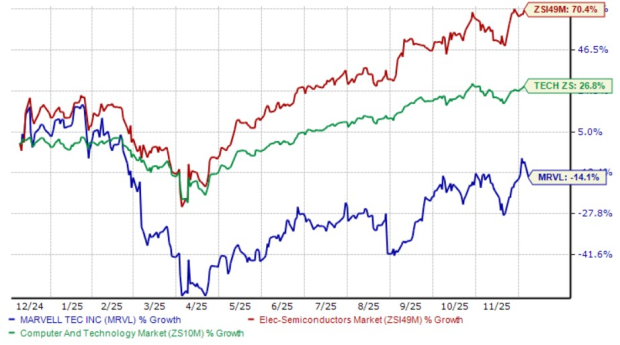

Marvell Technology (MRVL) reported a 14.1% decline in shares over the past year, underperforming both the Zacks Electronics – Semiconductors industry’s growth of 70.4% and the Zacks Computer and Technology sector’s growth of 26.8%. For the third quarter of fiscal 2026, Marvell’s data center segment generated revenues of $1.52 billion, marking a 37.8% year-over-year increase, driven by demand for custom XPU silicon and networking products.

Marvell has also announced the acquisition of Celestial AI, enhancing its capabilities in the AI-driven interconnect space. Additionally, it has established collaborations with industry leaders like Amazon Web Services and NVIDIA to provide connectivity products tailored for AI applications. The Zacks Consensus Estimates forecast a revenue growth rate of 42% and earnings growth rate of 81% for fiscal 2026.

Despite the competitive landscape featuring players like Broadcom and Advanced Micro Devices, Marvell’s expansion in AI and high-speed networking solutions positions it well for future growth, suggesting favorable investment potential for MRVL.

“`