Netflix, Inc. (NFLX) is scheduled to report its second-quarter earnings on Thursday, after market close. The company generated $10.5 billion in revenue for Q1 2024, marking a 13% increase year-over-year, with earnings per share (EPS) of $6.61, a 25% rise compared to the same period last year.

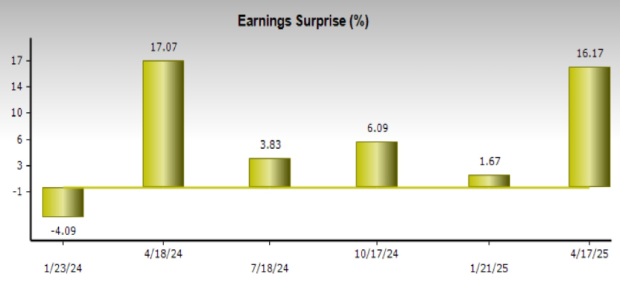

For Q2, Netflix anticipates revenues of $11.04 billion, a 15.4% year-over-year increase, and a projected EPS of $7.03, a 44.1% increase from last year. The company also forecasts an increase in operating margins from 27.2% to 33.3%. With a positive earnings surprise average of 6.9% over the last four quarters, Netflix is positioned for potential growth that could positively impact its stock price.

Currently, Netflix’s price-to-earnings (P/E) ratio stands at 49.62, significantly higher than the Broadcast Radio and Television industry’s 35.79, suggesting that its growth potential may be limited. Investors should prepare for volatility depending on the performance relative to expectations, which could lead to a sell-off if the company fails to meet projections.