Understanding Nutanix: A Look at Wall Street’s Recommendations

Before deciding whether to Buy, Sell, or Hold a stock, many investors consider Wall Street analysts’ recommendations. But do these ratings truly impact stock prices? Let’s examine Nutanix (NTNX) and the significance of brokerage guidance.

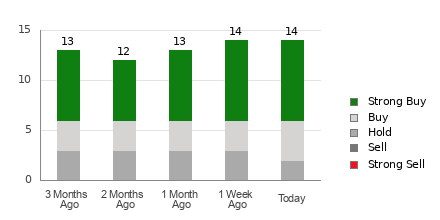

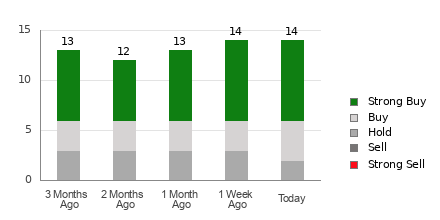

Nutanix has an average brokerage recommendation (ABR) of 1.54 on a scale from 1 to 5, with 1 being Strong Buy and 5 being Strong Sell. This ABR is determined by the recommendations of 14 brokerage firms, indicating a leaning toward a Strong Buy.

Specifically, out of these recommendations, eight rate it as Strong Buy and four as Buy. This means 57.1% of the recommendations are Strong Buys, while 28.6% are Buys.

Current Trends in Brokerage Recommendations for NTNX

Explore Nutanix’s price target and stock forecast here>>>

While these recommendations suggest buying Nutanix, relying solely on this advice might not be wise. Research shows that brokerage recommendations often fail to lead investors to stocks with significant price potential.

Why is that the case? Brokerage analysts may exhibit a positive bias influenced by the interests of their firms. On average, there are five Strong Buy ratings for every one Strong Sell recommendation, meaning the recommendations may not align with actual market movements.

Using these ratings can complement your own research. They might support your analysis or resonate with indicators known for accurately predicting stock price trends.

Zacks Rank, a proprietary rating tool known for its strong track record, categorizes stocks into five groups, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This model effectively indicates potential price performance in the near future. Therefore, combining the ABR with Zacks Rank can aid in more informed investment decisions.

Distinguishing Between ABR and Zacks Rank

Despite both being rated on a scale from 1 to 5, the ABR and Zacks Rank differ significantly.

The ABR is based on brokerage recommendations and presented with decimal points (for example: 1.28). The Zacks Rank, however, is a quantitative model focusing on earnings estimate revisions and displayed in whole numbers (1 to 5).

Brokerage analysts have traditionally been overly optimistic in their evaluations, often providing more favorable ratings than their research justifies. This bias can mislead rather than guide investors effectively.

Conversely, the Zacks Rank relies on earnings estimate revisions, which have consistently shown a strong correlation with short-term stock price changes.

The Zacks Rank also provides a consistent grading system across all stocks for which earnings estimates exist. This means the rankings retain their balance across the five categories.

Another important aspect is how current the ratings are. The ABR may not reflect the latest information. However, Zacks Rank quickly adjusts to the latest earnings estimates from analysts, making it a timely indicator of future price movements.

Is Nutanix Worth Your Investment?

For Nutanix, the Zacks Consensus Estimate for the current year remains stable at $1.49, indicating analysts have consistent views about the company’s earnings prospects.

This stability in consensus estimates suggests that Nutanix may perform in line with the broader market soon. Currently, the stock holds a Zacks Rank of #3 (Hold) due to various factors, including the unchanged consensus estimate. For more information, you can find the full list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

Given these factors, it may be wise to approach Nutanix’s Buy-equivalent ABR with caution.

Zacks Unveiling Top 10 Stocks for 2025

Interested in discovering our top picks for 2025?

Historically, these selections have outperformed the market. From 2012, when Sheraz Mian took charge of the Zacks Top 10 Stocks portfolio, these picks gained +2,112.6%, significantly surpassing the S&P 500’s +475.6%. Sheraz is currently analyzing 4,400 firms to identify the best 10 stocks for the upcoming year. Ensure you’re ready to invest as these stocks become available on January 2.

Be the First to Find Out New Top 10 Stocks >>

Nutanix (NTNX): Free Stock Analysis Report

Read the full article on Zacks.com by clicking here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.