**Oracle Faces Financial Concerns Amid AI Investment**

Oracle Corporation (ORCL) is grappling with market anxiety over its ties to OpenAI and its ability to finance data center expansions. In its latest quarterly results released on December 10, 2025, Oracle missed revenue and margin expectations, raising its capital expenditure outlook significantly from $6.7 billion in FY 2024 to $21.2 billion in FY 2025. The company is projected to face a $50 billion capex budget for FY 2026, likely outpacing its operating cash flows, indicating a potential for negative free cash flow into FY 2027.

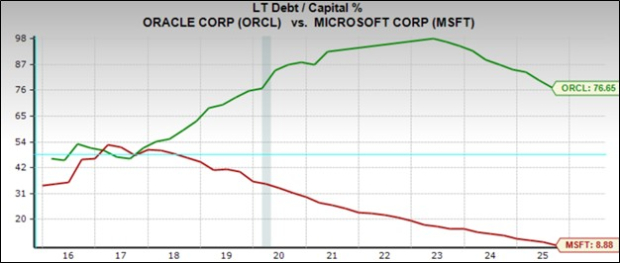

Despite maintaining an investment-grade credit rating with S&P, Oracle’s financial health has drawn scrutiny, given its heavy reliance on debt for funding. The company’s Remaining Performance Obligations (RPO) surged to $523 billion, attributed largely to OpenAI, raising concerns about customer concentration risks. Oracle stock has demonstrated volatility, diminishing investor confidence compared to peers like Microsoft and Alphabet, with the former’s shares currently trading at an 18% discount relative to Microsoft, marking a significant shift in its historical valuation.