“`html

Palantir Technologies (PLTR) and Advanced Micro Devices (AMD) reported strong AI-driven Q3 results, surpassing earnings expectations and raising their future revenue guidance. Palantir increased its full-year revenue outlook by $250 million to $4.39–$4.4 billion, driven by a 63% increase in Q3 sales to $1.18 billion, with its U.S. commercial segment revenue up over 120%. AMD’s Q3 sales reached $9.24 billion, a 35% increase, prompting a Q4 sales guidance increase by $400 million to $9.6 billion.

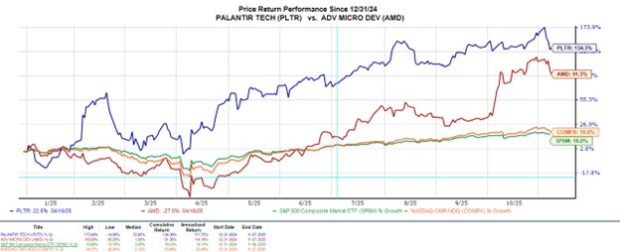

Despite these results, share prices have declined over 10% this month due to concerns about high valuations, with PLTR trading at a forward earnings multiple of 266x and AMD at 60x. Palantir now expects its full-year adjusted operating income to exceed $2.15 billion and full-year free cash flow to range between $1.9 billion and $2.1 billion.

Both companies face scrutiny over their lofty valuations amid the market’s pullback. Palantir’s price-to-sales ratio stands at 99x, while AMD’s is at 11x against the S&P 500’s 5x. Nevertheless, analysts view Palantir positively, with a Zacks Rank of #2 (Buy), predicting robust EPS growth for the coming years.

“`