Plexus Corp. (PLXS) shares rose 7.5% on the last trading session to close at $172.35, with strong trading volume indicative of heightened investor interest. The company’s recent growth is attributed to increased demand in the electronics manufacturing services (EMS) sector, particularly related to AI and industrial applications, resulting in 141 manufacturing wins totaling $941 million in annualized revenues for fiscal 2025.

Plexus projects quarterly earnings of $1.77 per share, representing a year-over-year increase of 2.3%, while expected revenues are $1.07 billion, a 9.7% rise from the previous year. The company also anticipates revenue growth for fiscal 2026, contingent upon improved end-market demand.

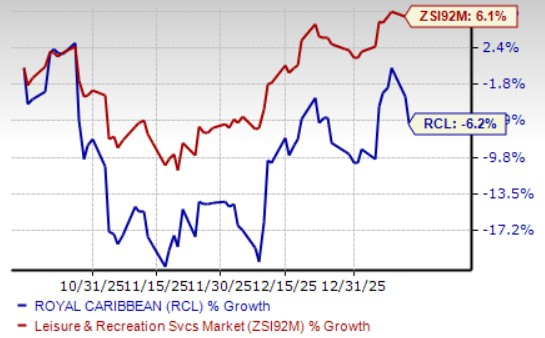

In a related industry note, Celestica (CLS) shares closed 4.4% higher at $328.56, with an upcoming EPS estimate of $1.73, reflecting a significant year-over-year change of 55.9%. Both Plexus and Celestica hold a Zacks Rank of #3 (Hold) in the electronics manufacturing sector.