Vanguard S&P Small-Cap 600 Value ETF Analysts See Potential Growth

Recent analysis reveals that the Vanguard S&P Small-Cap 600 Value ETF (Symbol: VIOV) could have room for growth based on insights from market analysts.

Currently trading at around $91.51 per unit, VIOV has an implied target price of $107.56 per unit, suggesting an upside potential of 17.54%. This target is backed by the average predictions for its underlying stocks. Notably, three holdings with significant upward potential are Topgolf Callaway Brands Corp (Symbol: MODG), Krystal Biotech Inc (Symbol: KRYS), and StepStone Group Inc (Symbol: STEP). For instance, while MODG’s recent share price stands at $8.31, analysts project it could rise to $14.08, indicating a potential upswing of 69.47%. Similarly, KRYS could see a 33.31% increase from its current price of $150.31, reaching $200.38. Analysts also expect STEP to climb 23.56% from its recent value of $57.29, with a target of $70.78.

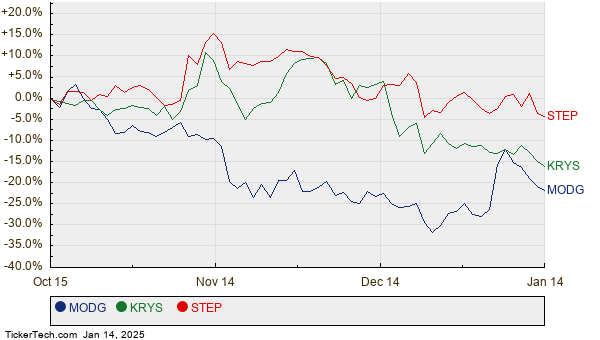

Below is a price history chart that illustrates the performance trends for MODG, KRYS, and STEP:

Here’s a summary of the analyst target prices for the selected stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P Small-Cap 600 Value ETF | VIOV | $91.51 | $107.56 | 17.54% |

| Topgolf Callaway Brands Corp | MODG | $8.31 | $14.08 | 69.47% |

| Krystal Biotech Inc | KRYS | $150.31 | $200.38 | 33.31% |

| StepStone Group Inc | STEP | $57.29 | $70.78 | 23.56% |

As investors consider these targets, they might wonder: Are analysts being realistic with their projections, or are they too optimistic? What justifications do analysts have for these numbers? A higher target relative to a stock’s price often reflects a positive outlook, yet it could also indicate an outdated forecast. Investors should conduct careful research to understand the current market dynamics.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Institutional Holders of BIRK

• Institutional Holders of MFMS

• TBLT Stock Predictions

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.