“`html

Visa and Mastercard: Earnings Expectations in Focus as Q4 Unfolds

The 2024 Q4 earnings season is underway, highlighting a busy week of reports from significant companies.

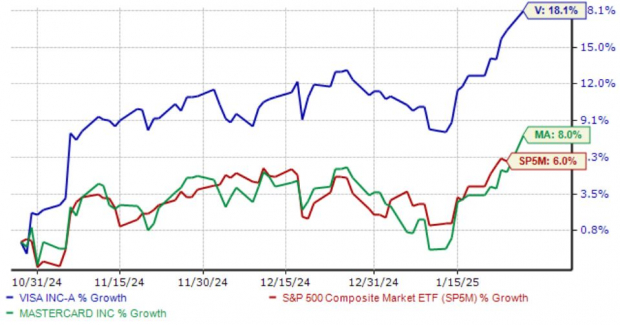

Among them are two competitors, Mastercard (MA) and Visa (V). Over the past three months, both stocks have shown strong performance, outperforming the S&P 500, with Visa experiencing particularly robust gains.

Image Source: Zacks Investment Research

What should investors anticipate from these financial giants as they prepare to announce their earnings? Let’s delve deeper.

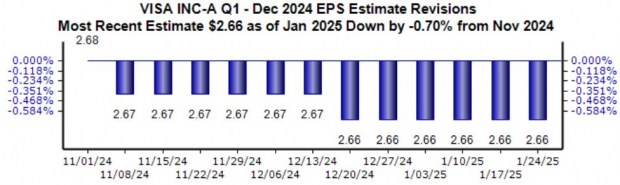

Marginal Revisions Indicate Cautious Outlook

Recent months have seen slight downward adjustments to EPS expectations for both Visa and Mastercard. Visa’s expected EPS stands at $2.66 per share, indicating an 11% growth year-over-year. For Mastercard, the Zacks Consensus EPS estimate is $3.68, reflecting a 15% increase from last year.

Visa –

Image Source: Zacks Investment Research

Mastercard –

Image Source: Zacks Investment Research

Expectations for sales largely mirror EPS trends, with both Visa and Mastercard seeing minor decreases in their forecasts. Nonetheless, sales projections remain solid, with Mastercard anticipated to achieve a 15% growth in sales, while Visa’s revenue is expected to increase by 10% year-over-year. Even amid modest downward revisions, both companies still project notably strong year-over-year growth.

Valuations Suggest High Growth Expectations

Current valuations indicate that both stocks are slightly pricier compared to their historical averages, reflecting investor optimism about future growth. Mastercard shares are trading at a forward earnings multiple of 32.5X for the next 12 months, while Visa’s multiple stands at 28.3X.

While these figures are above their five-year median values, they remain significantly lower than their five-year peaks. The same pattern applies to their current PEG ratios, which exceed five-year medians but fall short of previous highs.

Image Source: Zacks Investment Research

Even though the current multiples suggest a bit of stretch, the expected growth is driven largely by ongoing consumer demand and the overall strength of the U.S. economy. In their most recent quarterly results, both companies attributes their success to increased volumes in various critical segments.

Conclusion

As we progress further into the 2024 Q4 earnings cycle, a diverse array of quarterly reports will capture investors’ attention in the upcoming weeks.

This week, among the highlighted companies are Visa (V) and Mastercard (MA). Despite a few modest downward revisions over recent months, expectations remain steady. The rise in valuation multiples reflects investor confidence in continued strong consumer spending, with both companies poised to report double-digit year-over-year growth in both EPS and sales.

With positive momentum surrounding both stocks, investor optimism appears likely to continue as they approach their earnings releases.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our analysts recently identified five stocks with the potential to climb significantly in the coming months. Among these, Director of Research Sheraz Mian singles out one stock with impressive growth prospects.

This standout is backed by a rapidly growing customer base of over 50 million and offers a range of innovative financial solutions, positioning it for substantial growth. While not every recommendation results in success, this stock could outperform previous Zacks selections, like Nano-X Imaging, which soared by +129.6% within just nine months.

Free: See Our Top Stock And 4 Runners Up

Mastercard Incorporated (MA): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`