“`html

Inflation Surge and the Battle for OpenAI: Key Insights and Future Implications

From yesterday’s Digest:

Three inflation reports this week could be catalysts to help stocks resume their march higher.

[If today’s CPI numbers] come in soft, the report could act as a defibrillator, jolting stocks back to life.

Unfortunately, we’re 0-for-1.

This morning, the January Consumer Price Index (CPI) inflation report exceeded expectations. As a result, the 10-year Treasury yield is up, while stocks are facing a decline, and the chances of rate cuts in 2025 have diminished.

Detailing the report, prices rose by 0.5% from December to January, higher than the 0.3% forecast by Dow Jones. The annual inflation figure was also above expectations at 3.0%, compared to the predicted 2.9%.

Core CPI, which excludes volatile food and energy costs, increased by 0.4% for the month, bringing the yearly rate to 3.3%. This figure also exceeded predictions of 0.3% and 3.1%.

Shelter costs are notably problematic, showing a 0.4% monthly rise, contributing roughly 30% to the overall CPI increase. Food prices also rose by 0.4%, driven largely by a staggering 15.2% increase in egg prices.

Earlier today, the 10-year Treasury yield jumped 12 basis points to 4.66%, marking its highest level in about a month. In the wake of this, the CME Group’s FedWatch Tool reveals that most traders now anticipate only one rate cut in 2025.

As for stocks, all three major indexes were down earlier this morning, although the declines were not stark. The trend reflects a continued sector rotation from technology to areas such as financials and healthcare.

Prominent investor Louis Navellier remains unfazed by the report or the market reaction. Here’s his perspective from the Growth Investor update:

Because of the CPI, the Fed’s probably not going to cut rates anytime soon. Fed Chair Jerome Powell did confirm that.

They will be cutting rates later in the year, because Europe and the Bank of England will be slashing rates…

[Due to the CPI reading], bond yields are up about 12 basis points this morning…

[Because of this], there will be an adverse market reaction, but then I think the market will just regroup and be fine.

As I write during lunch, all three stock indexes have recovered from their earlier lows, with the Nasdaq even reversing to positive territory.

Bottom line: This CPI report did not meet our hopes, but it is not a reason to abandon this bull market. Stay tuned for tomorrow’s Producer Price Index (PPI) report, where we hope to see more encouraging data.

Unpacking the Musk-Altman Conflict

This week, a consortium led by Elon Musk proposed $97.4 billion to acquire the nonprofit organization overseeing OpenAI (the creator of ChatGPT).

This buyout offer adds another layer to the ongoing feud between Musk and OpenAI’s CEO, Sam Altman. Back in 2015, the two collaborated to co-found OpenAI as a nonprofit dedicated to safely advancing digital intelligence for humanity.

Musk exited in 2019, with various theories surrounding his departure. Some speculate concerns over potential conflict due to Tesla’s ventures into AI, while others suggest disagreements regarding equity stake desires.

Over the years, their rapport has deteriorated into personal attacks, paving the way for Musk’s recent unsolicited buyout bid.

A primary disagreement appears to hinge on OpenAI’s direction: should it operate for profit or remain a nonprofit? The Wall Street Journal notes:

[Musk’s] unsolicited offer adds a complication to Altman’s carefully laid plans for OpenAI’s future, including converting it to a for-profit company and spending up to $500 billion on AI infrastructure through a joint venture called Stargate. He and Musk are already fighting in court over the direction of OpenAI.

“It’s time for OpenAI to return to the open-source, safety-focused force for good it once was,” Musk stated. “We will make sure that happens.”

Legal complaints filed by Musk express concerns that OpenAI has strayed from its original nonprofit mission, particularly with its partnership with Microsoft.

The Bigger Picture: AGI and Its Implications

AGI, or artificial general intelligence, represents a crucial milestone where machines achieve or exceed human-like intelligence.

Both Musk and Altman hold different views on the timeline and regulation surrounding AGI. Musk advocates for regulatory oversight to prevent potential risks associated with advanced AI.

Musk shared, “I’m increasingly inclined to think that there should be some regulatory oversight, maybe at the national and international level, just to make sure that we don’t do something very foolish.”

Conversely, Altman expresses optimism about the imminent arrival of AGI, projecting that by 2025, AI agents may integrate into the workforce, significantly transforming productivity.

Altman remarked, “We are now confident we know how to build AGI as we have traditionally understood it… We believe that, in 2025, we may see the first AI agents ‘join the workforce’ and materially change the output of companies…”

While many hope for beneficial advances from AGI, Altman cautions that significant challenges concerning AGI safety will likely arise, which may not be well-received.

He stated, “There will likely be some major decisions and limitations related to AGI safety that will be unpopular…” He also mentioned the risk of AI being misused by authoritarian regimes for surveillance and control.

The Countdown to AGI: Insights from Eric Fry

On September 12, Eric Fry began a countdown he dubbed “1,000 Days to AGI,” recognizing key advancements in AI development.

According to Eric, AI is evolving into models capable of reasoning, making major strides toward achieving AGI.

Reflecting on his timeline, Eric commented:

I’m convinced 1,000 days is the far end of when we’ll achieve AGI.

And with each new AI milestone, we’re getting ever closer.

Reflecting on AGI’s Societal Impact

“`

The Future of AGI and Crypto: Preparing for Economic Shifts

Anticipating the Impact of AGI

As the world grapples with the unclear nature of Artificial General Intelligence (AGI), Eric asserts that investors can still make wise decisions.

If you’re concerned about a potentially bleak future with AGI, generating wealth from it may be one of the most prudent actions to take—perhaps even more effective than building a fortified shelter.

This financial strategy might be particularly vital if AGI indeed takes over jobs, a possibility many analysts are warning about.

Take for example Brian Aghazadeh, Principal Civil Engineer at Concept Engineers:

Some estimates suggest that 10-50% of existing jobs may face disruption from automation over the next few decades, affecting roles that require predictable manual labor, basic data entry, and even accounting or administrative support…

Unlike current artificial intelligence, which is designed for specific tasks, AGI would have the ability to tackle virtually any intellectual endeavor.

Returning to Eric’s insights on investments:

Those who are unprepared might miss out on transformative opportunities presented by AGI.

Conversely, investors who strategically position themselves could experience unprecedented financial success—possibly even more substantial than gains witnessed during the Internet Revolution.

Eric has identified several companies that are set to benefit from the “pre-AGI” market. For more information, check out his complimentary 1,000 Days to AGI broadcast, where he discusses AGI’s implications and how to get financially ready.

Regardless of how the Musk-Altman situation develops, it is clear: AGI is rapidly approaching, promising significant changes in many sectors.

Insights for Cryptocurrency Investors

As mentioned in yesterday’s Digest, Bitcoin seems to be at a standstill.

Having reached a peak of approximately $108,000 in December, Bitcoin has since retreated and struggles to reclaim the $100,000 milestone. The anticipated rise to $120,000 remains elusive.

Is a market crash on the horizon?

While it’s a possibility, predicting crashes is notoriously difficult, particularly in volatile markets like cryptocurrency.

Understanding historical trends is crucial at such junctures.

Mario Nawfal, a well-known entrepreneur and head of the Athena Group of Companies, shared:

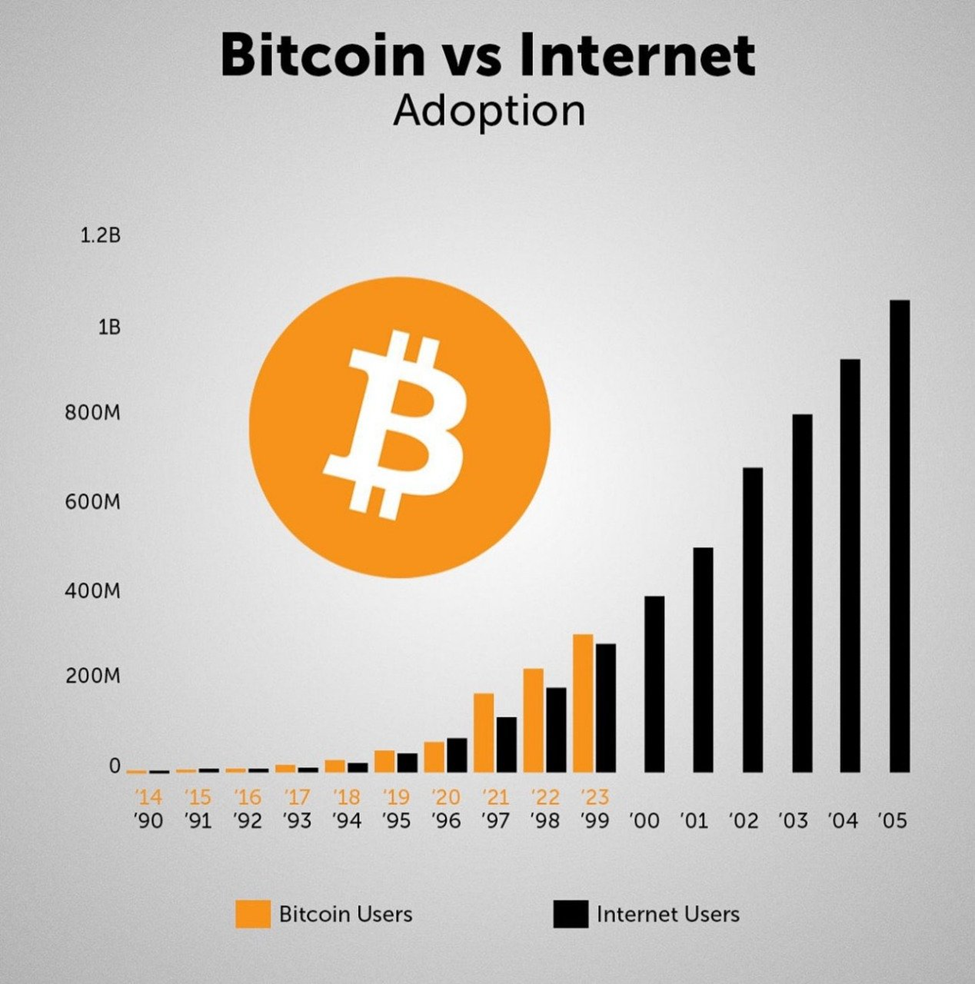

Crypto has amassed 300M users in just 12 years—43% faster than mobile phones and 20% quicker than the internet, according to BlackRock.

Drivers of this growth include younger generations, escalating inflation concerns, and a supportive stance on crypto from political figures like Trump.

With Bitcoin ETFs expected to reach $250B and ongoing regulatory advancements, cryptocurrency is swiftly moving into the mainstream.

A compelling chart from BlackRock illustrates Bitcoin’s user adoption rate (in gold) compared to that of the internet (in black).

Source: BlackRock

Investors should consider the larger context before making significant moves with their cryptocurrency investments.

Regarding the mention of “Trump’s pro-crypto stance,” our crypto analyst Luke Lango believes there are more significant pro-crypto developments on the horizon.

Luke predicts three major decisions from Trump in the first 100 days of his next term that could trigger an unprecedented crypto boom.

If you missed it, you can watch a free replay of his presentation on the Great American Crypto Project.

We will keep you informed on these topics right here in the Digest.

Wishing you a pleasant evening,

Jeff Remsburg