Lululemon’s Strong Q3 Results Surprise Investors

The Q3 reporting period has come to a close, with most companies sharing their quarterly results. Overall, this round produced positive earnings growth, largely fueled by the technology sector. However, one late report from lululemon LULU shocked investors with unexpectedly strong results.

Strong Earnings and Margin Growth

LULU exceeded expectations by reporting earnings per share (EPS) that were 7% higher than the Zacks Consensus estimate. Sales also surpassed forecasts by 2%, reflecting growth from the previous year. Remarkably, the most significant highlight was a 150 basis point improvement in gross margin, now at 20.5%. The gross profit reached $1.4 billion, indicating a solid 12% year-over-year increase.

Comparable store sales rose by 4% compared to the previous year, demonstrating the company’s ability to achieve growth at existing locations. Furthermore, lululemon expanded its presence by opening 28 new stores during this quarter.

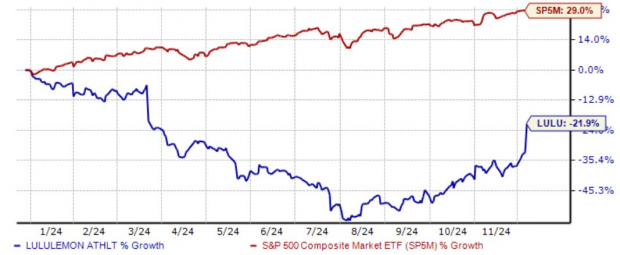

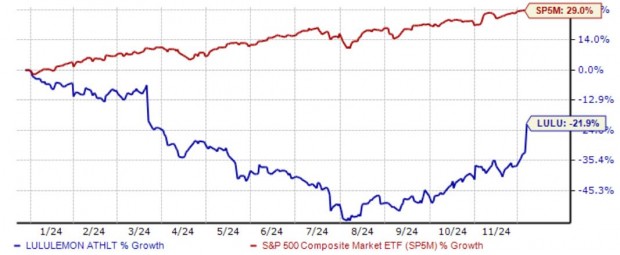

These strong results led to a surge in shares, a welcome relief for investors after a challenging start to 2024. The stock has increased 60% over the last three months, significantly outperforming the market during this time. Below is a chart illustrating the year-to-date performance of LULU shares.

Image Source: Zacks Investment Research

To further reinforce investor confidence, lululemon announced a $1 billion increase to its existing stock buyback program. This move is expected to support the stock’s value in the coming months.

Bottom Line

Lululemon LULU’s impressive Q3 results have brightened the earnings cycle, showcasing strong performance that pleased investors and resulted in a notable uptick in share prices.

7 Top Stocks to Watch for the Next Month

Experts have identified 7 elite stocks from the current pool of 220 Zacks Rank #1 Strong Buys, labeling these tickers as “Most Likely for Early Price Pops.”

Since 1988, this list has outperformed the market by more than double, achieving an average gain of +24.1% per year. It’s wise to take immediate notice of these selections.

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Read the full article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.