Reddit Inc. (RDDT) has experienced a 49.6% surge in share price over the past month, attributed to strong second-quarter 2025 results and optimistic third-quarter guidance. The company’s second-quarter earnings reached 45 cents per share, surpassing the Zacks Consensus Estimate by 25 cents. Revenue for the quarter totaled $499.63 million, exceeding expectations by 16.9% and showing a year-over-year increase of 77.9%.

Looking ahead to the third quarter of 2025, Reddit anticipates revenues between $535 million and $545 million, indicating a year-over-year growth of 54-56%. The Zacks Consensus Estimate for third-quarter revenues is at $549.59 million, with an expected earnings consensus of 49 cents per share, up from 16 cents per share in the prior year.

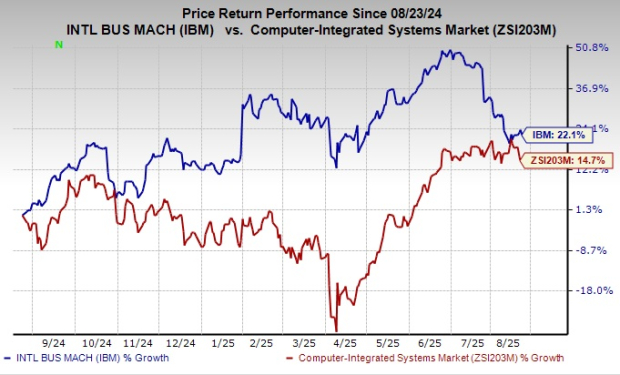

Year-to-date, RDDT shares have risen 33.5%, outperforming the Zacks Computer & Technology sector return of 11.8%. Key revenue growth drivers include advertising revenue, which surged 84% year-over-year to $465 million, reflecting a robust demand for new advertising formats.