Seagate’s Q1 Report Looms: Can It Sustain Its 34% Surge?

Note: FY’24 ended in June 2024

Seagate stock (NASDAQ: STX), a leader in electronic data storage solutions, is set to announce its first-quarter results on Tuesday, October 22. Financial analysts expect minimal changes in STX’s stock price, as revenue and earnings are projected to meet expectations for fiscal Q1. This year, Seagate’s share price has increased by 34%, rising from $85 to $112. In comparison, the S&P 500 experienced a growth of about 22%. Another competitor, Western Digital stock (NASDAQ: WDC), recorded a 29% rise during the same timeframe. The increased demand for storage, fueled by the AI boom, is encouraging a shift toward higher-capacity drives as well as improved pricing.

Seagate is now concentrating on HAMR (Heat Assisted Magnetic Recording) technology, which allows for significantly longer lifespan hard drives compared to traditional ones. Currently, the company is shipping 30 TB hard disks using this innovative technology. With increasing demand for HAMR disks fueled by the expansion of AI, Seagate is strategically positioned to capitalize on this trend. The growing need for memory and storage to accommodate larger volumes of data is making Seagate’s mass-capacity drives more vital for enterprises. Furthermore, Seagate’s financial health is showing improvements; its operating margin dropped from 14% in FY 2021 to 1% in FY 2023, but it has rebounded to 6% in FY 2024. Analysts anticipate further recovery in margins ahead.

Investors have responded positively to STX’s stock, driven by a resurgence in storage product sales and an improvement in profit margins. However, the stock’s performance over the past three years has been inconsistent, with returns fluctuating significantly. In 2021, STX saw an impressive 88% return, but this was followed by a 51% decline in 2022 and a 69% increase in 2023. This volatility starkly contrasts with the Trefis High Quality (HQ) Portfolio, which includes a diverse group of 30 stocks and has consistently outperformed the S&P 500 during the same timeframe. The HQ Portfolio tends to deliver better returns with reduced risk. Amid ongoing concerns about economic stability, rate cuts, and international conflicts, could STX experience another downturn like in 2022, or will it maintain its upward trajectory?

Forecasts show that Seagate’s Valuation currently sits at $118 per share, which is approximately 6% higher than the current trading price. For more details, see our interactive dashboard analysis on STX’s Earnings Preview: What To Expect in Q1?

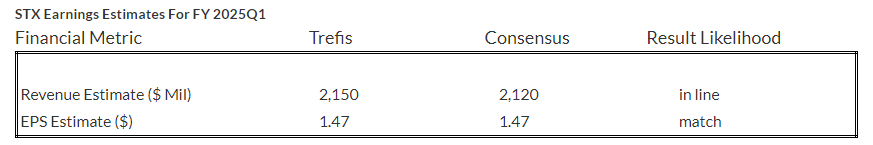

(1) Earnings and Revenue Anticipated to Align with Market Expectations

Trefis estimates Seagate’s FQ1 2025 revenues at $2.2

billion, which aligns with market expectations. In Q4 2024, revenue increased 18% year-over-year to $1.9 billion, attributed to recovering cloud demand in both the U.S. and China. Additionally, Seagate shipped 398 exabytes of HDD storage capacity in fiscal 2024, slightly down from 441 exabytes the previous year. However, in Q4 alone, HDD shipments saw a 15% sequential increase. This positive momentum is likely to continue as demand for storage rebounds and Seagate maintains its focus on HAMR products. We predict Seagate’s revenue to grow 40% year-over-year, reaching $9.2 billion in 2025. Earnings per share (EPS) for FQ1 2025 is expected to be $1.47, consistent with consensus estimates.

(2) Stock Price Estimate Aligns with Current Market Levels

We estimate Seagate’s Valuation at $118 per share, indicating over 5% potential upside from the current price of around $112. The price-to-sales (P/S) ratio for Seagate has varied between 1.2x and 3.3x in the last three years, largely due to a substantial 37% decrease in sales during fiscal 2023, followed by another 11% drop in fiscal 2024 (which ends in June). Our $118 valuation is based on a 16.9x price-to-earnings multiple along with adjusted earnings of $6.95 per share in FY 2025.

To better understand where Seagate stands among its competitors, visit our Peer Comparisons section for insight into key performance metrics.

While investors hold out hope for a gradual recovery in the U.S. economy, concerns linger about the possible impact of another recession. Our dashboard, How Low Can Stocks Go During A Market Crash, tracks how major stocks performed during previous market downturns.

| Returns | Oct 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| STX Return | 2% | 34% | 317% |

| S&P 500 Return | 1% | 22% | 161% |

| Trefis Reinforced Value Portfolio | 3% | 18% | 789% |

[1] Returns as of 10/21/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.