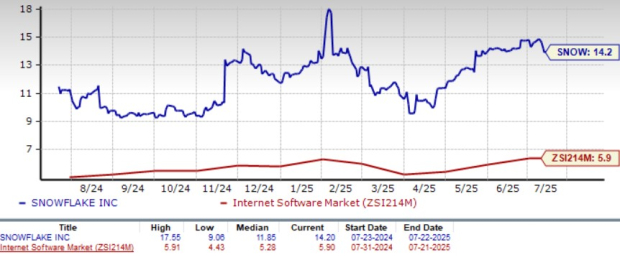

Snowflake Inc. (SNOW) is currently facing concerns over its valuation, holding a Value Score of F. The company is trading at a forward Price/Sales (P/S) ratio of 14.2X, significantly higher than the industry average of 5.9X. In comparison, competitors Teradata (TDC) and MongoDB (MDB) sit at P/S ratios of 1.3X and 7.5X, respectively.

Year-to-date, SNOW shares have risen 37.6%, while the broader Zacks Computer and Technology sector gained 10.6% and the industry increased by 19.3%. As of its first quarter, Snowflake reported product revenues of $996.8 million, marking a 26% increase year-over-year, and anticipates revenues of $1.03-$1.04 billion for Q2 of fiscal 2026, projecting 25% growth year-over-year.

Snowflake also saw its customer base rise to 11,578, an 18% increase year-over-year, with expectations for 11,961 by the following quarter. Despite strong performance, competitive pressures from major cloud providers and rising infrastructure costs represent ongoing risks for the company.