Target’s Holiday Performance: A Bright Spot in Retail Earnings

The holiday season plays an essential role for retailers, often setting the stage for their annual financial performance. Target Corporation (TGT), recognized for its wide array of products and competitive prices, recently announced its results for the holiday sales period. This raises the critical question: Should investors buy, hold, or sell Target stock after such significant results?

Key Highlights from Target’s Holiday Sales

Target’s holiday performance exceeded expectations, demonstrating healthy traffic growth. The company’s blend of in-store and online offerings attracted a wide range of shoppers. Total sales for November and December saw an increase of 2.8% over the previous year, with comparable sales improving by 2%. Additionally, digital sales surged by 9% compared to the same timeframe last year.

When looking at the third-quarter trends, Target noted a significant increase in discretionary spending during the holidays. Sales of apparel and toys rose notably, while frequent purchase categories like beauty maintained steady sales. This diverse demand indicates that Target is successfully positioning itself as a go-to destination for both seasonal and everyday shopping needs.

Revised Estimates Following Strong Sales Performance

In light of the positive holiday results, Target has updated its sales forecasts. The company now anticipates a 1.5% increase in comparable sales, a revision from its previous outlook of flat sales. On the earnings front, Target continues to project its fourth-quarter adjusted earnings per share (EPS) in the range of $1.85 to $2.45, with full-year adjusted EPS targeted between $8.30 and $8.90.

Analysts have reacted favorably, revising their EPS estimates upward. Over the past week, estimates for the current and next fiscal years have increased by 8 and 7 cents, now sitting at $8.68 and $9.32 per share, respectively.

Check the Zacks Earnings Calendar for key market updates.

Image Source: Zacks Investment Research

Factors Supporting Target’s Strong Performance

Target’s brand strength, diverse product range, and growing e-commerce capabilities have all contributed to its market success. The company is enhancing its physical and digital presence through innovation and AI integration, which collectively fortify its long-term growth potential.

By offering services like same-day delivery, curbside pickup, and customized online shopping options, Target has notably improved the shopping experience. These initiatives give Target an edge against industry competitors such as Amazon (AMZN), Walmart (WMT), and Dollar General (DG).

Additionally, Target’s strategy of combining national brands with its private-label products underlines its role as a comprehensive shopping destination. Price reductions across thousands of offerings bolster its appeal to budget-conscious consumers, while the Target Circle loyalty program enhances customer retention.

Target is also focused on improving its future growth prospects through disciplined capital investment, planning to allocate nearly $3 billion in fiscal 2024 and potentially increasing that to $4-$5 billion in fiscal 2025.

Analyzing Target’s Valuation

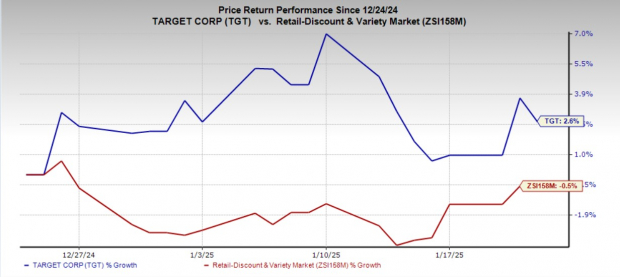

Although Target’s stock has risen by 2.6% over the past month—contrasting with a 0.5% decline in the broader retail sector—the company’s shares are trading at a notable discount when compared to historical norms and industry averages.

Image Source: Zacks Investment Research

Currently, Target’s forward 12-month price-to-earnings (P/E) ratio is 14.68, significantly lower than the industry average of 30.61. This figure also lags behind Target’s own median forward P/E of 15.12 over the past year, suggesting potential undervaluation compared to its historical trading levels.

Image Source: Zacks Investment Research

Such a valuation suggests that while Target is performing well, the broader market may not fully appreciate its growth potential and strategic direction. This could present a unique opportunity for value-driven investors to consider purchasing shares in the retail giant at an attractive price.

Investment Strategy for TGT Stock

Overall, Target’s impressive holiday performance reflects its ability to draw customers through its variety of products, competitive pricing, and enhanced shopping experience. With further investments in operational improvements and innovation, the company is well-equipped for sustained growth. Despite the recent uptick in its stock price, Target shares still offer a favorable investment proposition. Currently, TGT holds a Zacks Rank #2 (Buy).

7 Promising Stocks to Watch in the Coming Month

Recently released, experts have identified 7 elite stocks from Zacks Rank #1 Strong Buy list. These stocks are seen as most likely to experience early price increases.

Since 1988, this comprehensive list has outperformed the market by more than twice the average rate, achieving approximately +24.1% yearly gains. Ensure that you pay close attention to these seven selections.

For the latest recommendations from Zacks Investment Research, download the 7 Best Stocks for the Next 30 Days report.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

For the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.