Tesla’s Upcoming Earnings: Can the Stock Break Free from Bearish Trends?

Investors are gearing up for a crucial moment as Tesla Inc (TSLA) is set to release its third-quarter earnings after the market closes on Wednesday. Analysts forecast earnings per share of 58 cents alongside projected revenue of $25.37 billion. However, a significant question looms: will Tesla’s stock, currently down 12.26% year to date, be able to overcome its recent struggles?

Current Stock Trends Show Concerning Indicators

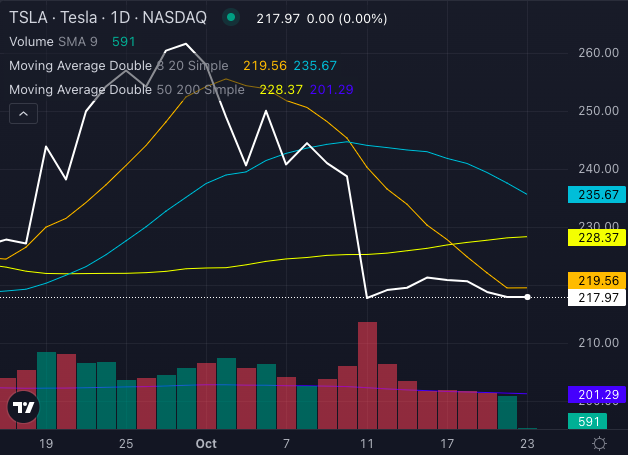

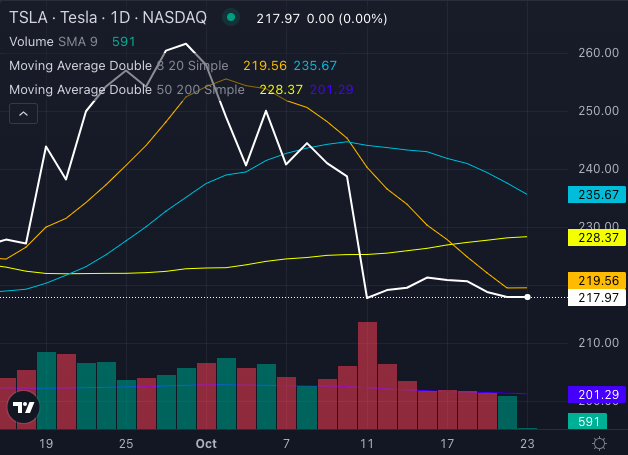

As of now, Tesla’s stock price stands at $217.97, and various technical indicators indicate a negative outlook.

Chart created using Benzinga Pro

The stock is trading below significant exponential and simple moving averages, with the five-day, 20-day, and 50-day EMAs all signaling bearish momentum. Specifically, the 20-day SMA is positioned at $235.67, and the 50-day SMA at $228.37, both significantly higher than the current price.

Chart created using Benzinga Pro

The Moving Average Convergence/Divergence (MACD) also shows a troubling sign at a negative 4.80, indicating sustained selling pressure. The Relative Strength Index (RSI) sits at 38.49, suggesting the stock might be nearing oversold conditions. Furthermore, with the lower Bollinger Band at $207.12, Tesla’s stock is precariously close to its lower support level, reinforcing bearish tendencies.

Read Also: Tesla Q3 Earnings Preview: Musk Has Questions To Answer, Traders ‘Need To Buckle Up’ For Volatile Stock Moves

Potential Reversal Signals for Tesla

Even with these bearish indicators, there remains a flicker of hope for Tesla proponents. If the RSI drops below 30, this could trigger buying momentum, suggesting a possible reversal. Additionally, Tesla’s share price hovering above the 200-day SMA of $201.29 maintains a more optimistic long-term outlook.

Challenges Facing Tesla Stock

Concerns regarding Tesla’s stock price stem from issues surrounding global demand and pricing strategies. Recent price cuts have led to fears over shrinking profit margins. Furthermore, worries about CEO Elon Musk‘s involvement in non-Tesla projects, including X (formerly Twitter) and political endeavors, contribute to investor uncertainty as earnings day approaches.

Investors are left wondering: can Tesla defy expectations and deliver a positive earnings report, or will the results reinforce the stock’s current downward trend?

https://www.youtube.com/watch?v=hO2duXOICWA[/embed>

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs