Tesla’s First-Quarter 2025 Earnings: What to Expect

Tesla (TSLA) is scheduled to release its first-quarter 2025 results on April 22, after the market closes. The Zacks Consensus Estimate is for earnings of 45 cents per share and revenues of $21.85 billion.

Over the past 30 days, the consensus estimate for earnings per share has fallen by 11 cents. This forecast indicates no change compared to the same quarter last year. Meanwhile, the revenue estimate suggests a slight year-over-year increase of 2.6%.

Earnings Performance Overview

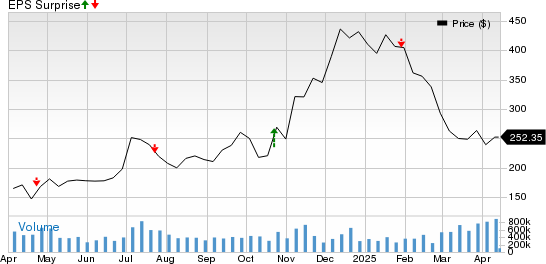

Tesla, Inc. price-eps-surprise | Tesla, Inc. Quote

Recent Earnings History

Tesla underperformed relative to earnings estimates in the last earnings season. Over the trailing four quarters, the company missed forecasts three times and exceeded them on one occasion, resulting in an average surprise of just 0.8%.

Delivery Challenges and Market Factors

In the first quarter of 2025, Tesla delivered 336,681 vehicles worldwide. This total includes 323,800 Model 3 and Model Y cars, along with 12,881 units from other models. Notably, this represents Tesla’s lowest quarterly delivery in over two years, down from 495,570 units in the fourth quarter of 2024 and 386,810 units in the same quarter last year. Deliveries fell short of the anticipated 426,407 units.

One significant factor for the lower deliveries was the company’s need to retool its factories to produce the new version of the Model Y SUV. Additionally, CEO Elon Musk’s political activities may have negatively impacted Tesla’s brand perception, contributing to declining sales.

Discounts and incentives may have also limited automotive revenue and gross margins. We project that revenue from automotive sales will be approximately $17.48 billion, with gross margins estimated at 15.8%. This marks a decline of 2 percentage points compared to the previous year.

Energy Storage and Future Prospects

Despite challenges in the automotive sector, Tesla anticipates growth in its energy generation and storage revenues, largely thanks to its Megapack and Powerwall products. In the first quarter of 2025, the company deployed 10.4 GWh of energy storage, reflecting a remarkable year-over-year increase of 156%. We estimate revenues from this segment to reach $2.1 billion, corresponding to a 70% growth compared to the prior year. Additionally, we expect Services and Other revenues to be around $2.5 billion, suggesting a 13% annual growth.

Investments in expanding capacity—not only for vehicle production but also for supercharging network services and battery technology—are likely to suppress operating profits. Tesla’s capital expenditures have been steadily increasing as the automaker prioritizes output capacity at its gigafactories, boosts 4680 battery cell production, enhances Supercharger infrastructure, and develops AI technologies. Unfortunately, the company anticipates a rise in operating expenses throughout 2025, which may further squeeze profit margins.

Model Predictions and Earnings Outlook

According to our model, an earnings beat for Tesla this season appears unlikely. A combination of a positive earnings ESP (Earnings Surprise Prediction) and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically increases the chances of positive earnings surprises, but that combination is not present here.

Earnings ESP: Tesla currently has an earnings ESP of -11.7%, as the Most Accurate Estimate is 5 cents below the Zacks Consensus Estimate. For insights on the top stocks to consider just before earnings, our earnings ESP Filter can be beneficial.

Zacks Rank: Tesla holds a Zacks Rank #5 (Strong Sell).

(See the Zacks earnings Calendar for upcoming market events.)

Possible Stock Candidates for Earnings Beats

While Tesla’s earnings potential remains uncertain, several automotive companies appear to be well-positioned to post earnings beats this quarter.

QuantumScape (QS) will announce first-quarter 2025 results on April 23. The company has an earnings ESP of +8.07% and a Zacks Rank #3. The consensus estimate for QuantumScape’s upcoming quarter loss is 21 cents per share. QuantumScape has exceeded earnings estimates once in the previous four quarters, missing on three occasions with an average negative surprise of 7%.

LKQ Corp. (LKQ) is set to release first-quarter 2025 results on April 24, boasting an earnings ESP of +3.19% and a Zacks Rank #3. The Zacks Consensus Estimate for LKQ’s earnings and revenues is 79 cents per share and $3.57 billion, respectively. LKQ has surpassed earnings estimates in two of the last four quarters and missed expectations in the other two, with an average negative surprise of 2.45%.

BorgWarner (BWA) plans to release first-quarter 2025 results on May 7, recording an earnings ESP of +5.24% and a Zacks Rank #3. The consensus estimate for BorgWarner’s quarterly earnings and revenues is 97 cents per share and $3.38 billion, respectively. BorgWarner has surpassed earnings forecasts in all of the last four quarters, with an average surprise of 17%.

7 Best Stocks for the Next 30 Days

Recently released: Experts have identified seven elite stocks from the current Zacks Rank #1 Strong Buys, which they believe are most likely to experience significant price increases soon.

Since 1988, this selected group has outperformed the market more than twice over, achieving an average annual gain of +23.9%. These carefully chosen stocks deserve immediate attention.

Interested in the latest recommendations from Zacks Investment Research? You can download the report on the 7 Best Stocks for the Next 30 Days here.

BorgWarner Inc. (BWA): Free Stock Analysis report

Tesla, Inc. (TSLA): Free Stock Analysis report

LKQ Corporation (LKQ): Free Stock Analysis report

QuantumScape Corporation (QS): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.