Target’s Earnings Woes: A Look at the Retail Giant’s Struggles

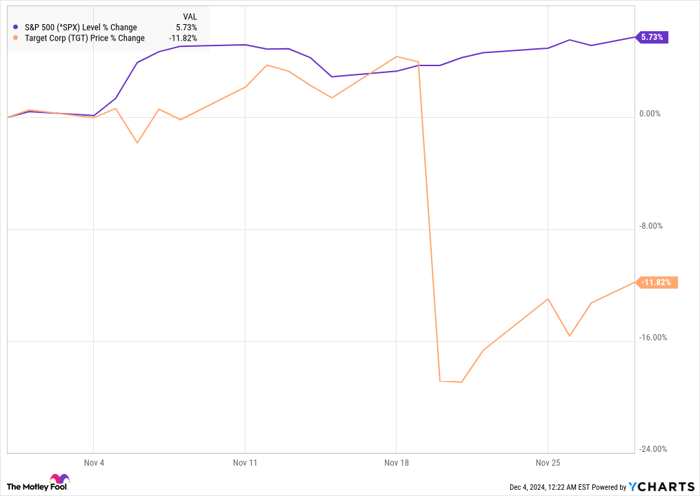

Shares of Target (NYSE: TGT) fell sharply last month. Even amid a broader stock market recovery, the company couldn’t escape the impact of yet another disappointing earnings report.

Target Faces Ongoing Challenges

After benefiting from pandemic-driven sales, Target has struggled to regain its momentum, as reflected in its latest third-quarter earnings. Comparable sales increased only 0.3%, leaving it trailing competitors such as Walmart. Although customer traffic rose by 2.4%, translating this into revenue growth proved difficult.

Inventory levels rose, negatively impacting margins, and increased spending on selling, general, and administrative expenses added to the pressure. Consequently, adjusted earnings per share fell by 12% to $1.85. The company explained that it built up inventory to avoid delays from a port strike, which it expects to be a one-time setback.

With both top and bottom line estimates missed, Target revised its guidance downward, now forecasting adjusted earnings per share of $8.30 to $8.90, a decrease from $9.00 to $9.70.

This led to disappointment among investors, prompting several Wall Street analysts to downgrade the stock. According to a report from The Wall Street Journal, many customers are expressing frustration with the retailer, citing issues like out-of-stock items, long checkout lines, and rising grocery prices.

Assessing the Path Forward for Target

Target remains one of the few multi-category retailers alongside Walmart and Costco, giving it some competitive edge. However, the company must address its operational challenges to regain strength in the market.

Looking ahead, experts predict consumer spending could improve as interest rates decrease. Nevertheless, economic factors such as tariffs from previous administrations might still pose challenges.

For the fourth quarter, Target’s guidance was also underwhelming, predicting flat comparable sales growth.

Nonetheless, Target’s stock appears undervalued, with a price-to-earnings ratio of 15. If the company were to restore consistent growth, its stock could see significant increases. However, this remains uncertain as ongoing struggles shift responsibility away from external economic influences.

Opportunity on the Horizon?

For investors feeling they missed out on high-performing stocks, news of potential “Double Down” stock recommendations might be of interest. This strategy highlights companies analysts believe are on the verge of significant gains.

Here are a few examples:

- Nvidia: A $1,000 investment back in 2009 would now be worth $359,445!*

- Apple: Investing $1,000 in 2008 has grown to $45,374!*

- Netflix: A $1,000 investment in 2004 would now amount to $484,143!*

If you’re looking for a similar opportunity, don’t miss the current alerts for three promising companies.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 2, 2024

Jeremy Bowman has positions in Target. The Motley Fool recommends Costco Wholesale, Target, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.