Tesla Stock Rises Amid Trump Administration Hopes

After a challenging year, Tesla (NASDAQ: TSLA) saw a significant increase in its stock last month. This surge followed President-elect Trump’s victory, as CEO Elon Musk has closely allied with him, having invested heavily in Trump’s campaign.

Consequently, the stock jumped after the election, continuing to rise as investors anticipated a favorable regulatory environment for Tesla under the upcoming administration.

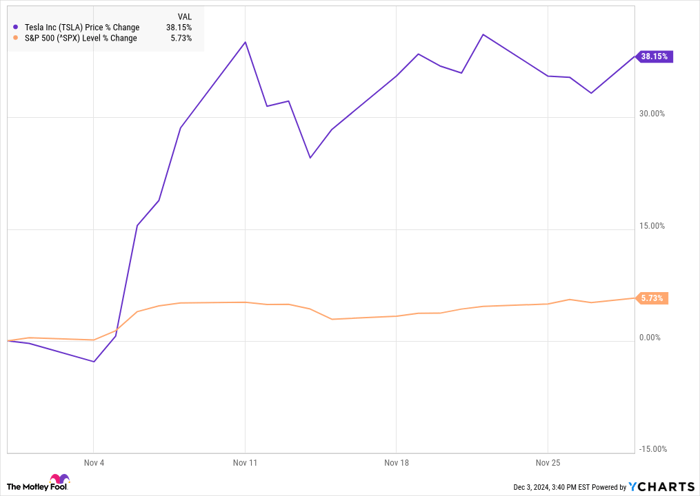

The peak occurred on November 11, before the stock steadied through the remainder of the month amid mixed news. Data from S&P Global Market Intelligence shows that shares gained 38% throughout November, with most growth taking place shortly after the election.

TSLA data by YCharts.

Elon Musk’s Political Gamble

It’s not surprising that Tesla’s stock rose with Trump’s win, given Musk’s prominent role as a supporter. His strong connection with Trump could influence policies beneficial for Tesla.

However, while Musk is well-connected and even heads the Department of Government Efficiency, the exact benefits for Tesla remain uncertain. Musk envisions federal regulations for autonomous vehicles which could expedite the launch of Tesla’s Cybercab. Nonetheless, public safety concerns may arise if those vehicles don’t meet stringent safety standards.

Moreover, Trump’s known support for fossil fuels and his plan to eliminate the $7,500 EV tax credit could create hurdles. Musk suggests that these changes will impact Tesla’s competitors more than his own company, but this shift demonstrates a less favorable stance on renewable energy compared to the previous Biden administration, posing potential challenges for Tesla.

Image source: Tesla.

A Look Ahead for Tesla

So far this year, Tesla has faced revenue stagnation and profit declines, but the company surprised analysts with better-than-expected growth in its third-quarter earnings report.

Challenges may arise from Trump’s tariff threats and escalating tensions with China, an essential market for Tesla.

The current stock valuation reflects high expectations for the company. With Musk projecting over 20% production growth for next year, investors appear to be banking on advancements in autonomy and favorable changes due to the Trump administration.

It’s advisable for investors to temper their expectations, considering Tesla’s recent difficulties and the possibility that the Trump administration could be less beneficial than anticipated.

A Glimpse of Lucrative Opportunities

Have you ever felt you missed out on investing in successful stocks? It might be time to reconsider.

Occasionally, our analysts highlight a “Double Down” stock recommendation for companies expected to rise rapidly. If you think you’ve missed your investment chance, now might be the perfect moment to buy. Historical performance is impressive:

- Nvidia: if you invested $1,000 when we recommended it in 2009, you’d now have $359,445!*

- Apple: if you invested $1,000 when we recommended it in 2008, you’d now have $45,374!*

- Netflix: if you invested $1,000 when we recommended it in 2004, you’d now have $484,143!*

Currently, we are issuing “Double Down” alerts for three promising companies, and opportunities like this may not last long.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 2, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.