“`html

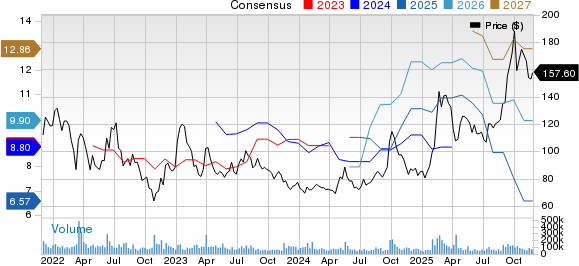

Alibaba Group Holding (BABA) reported its fiscal second-quarter 2026 results on November 25, revealing a revenue of RMB 247.8 billion—a 5% year-over-year increase—while non-GAAP earnings per American Depositary Share fell significantly to 61 cents, down 71% from the previous year.

Operating cash flow plummeted by 68% to RMB 10.1 billion, and free cash flow turned negative at an outflow of RMB 21.8 billion compared to an inflow of RMB 13.7 billion in the same quarter last year. The company’s adjusted EBITDA declined by 78%, attributed to high capital expenditures of RMB 31.9 billion on AI and cloud infrastructure.

Despite achieving revenue of RMB 39.8 billion in its Cloud Intelligence Group, up 34%, Alibaba faces intense competition from Amazon, Microsoft, and Google, which collectively hold 62% of the global cloud market. As of now, BABA’s stock price-to-sales ratio stands at 2.42, a premium compared to the industry average of 2.13, suggesting a stretched valuation amid uncertain profitability.

“`