Analysts Forecast Upside Potential for MDYG Amid Strong Stock Performance

In our latest analysis at ETF Channel, we examined the SPDR S&P 400 Mid Cap Growth ETF (Symbol: MDYG) and its underlying holdings. By comparing the current trading prices of these holdings to the average 12-month target prices set by analysts, we calculated a weighted average target price for the ETF. The result indicates that the implied analyst target price for MDYG is $100.00 per unit.

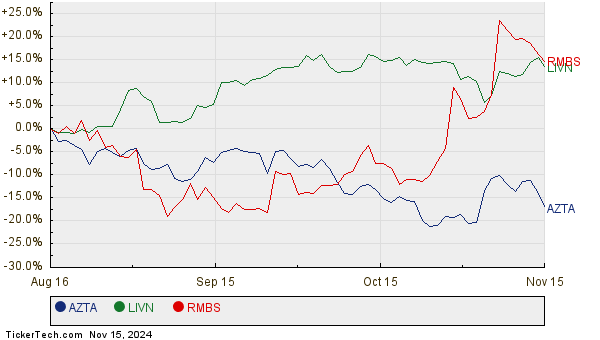

Currently, MDYG is trading around $90.72 per unit, suggesting analysts anticipate a 10.23% increase for this ETF based on underlying holdings. Among MDYG’s assets, three stocks stand out with significant expected upside to their target prices: Azenta Inc (Symbol: AZTA), LivaNova PLC (Symbol: LIVN), and Rambus Inc. (Symbol: RMBS). Azenta Inc is currently priced at $42.62 per share, but analysts predict a 41.23% rise to an average target of $60.20. LivaNova PLC, trading at $52.32, has a target price of $72.00—implying a potential gain of 37.61%. Rambus Inc. also shows promise, with a recent share price of $53.35 and an expected target of $67.60, translating to a potential increase of 26.71%. Below, we present a twelve-month price history chart comparing the stock performance of AZTA, LIVN, and RMBS:

Here is a summary table of the analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P 400 Mid Cap Growth ETF | MDYG | $90.72 | $100.00 | 10.23% |

| Azenta Inc | AZTA | $42.62 | $60.20 | 41.23% |

| LivaNova PLC | LIVN | $52.32 | $72.00 | 37.61% |

| Rambus Inc. | RMBS | $53.35 | $67.60 | 26.71% |

Should investors trust these analyst projections, or might they be too optimistic about future stock prices? It is essential to consider if the analysts have grounded these targets on solid recent developments in the companies and the broader industry. High price targets can signal strong growth expectations; however, they also risk being revised downwards if market realities shift. Investors are encouraged to conduct thorough research before making decisions based on these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• PRNT Options Chain

• Institutional Holders of NPWR

• Top Ten Hedge Funds Holding ARSD

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.