Mixed Results for ‘The Magnificent 7’ Stocks: A Shift in Market Leadership?

Of the six members of ‘The Magnificent 7’ group of stocks that have reported September-quarter results so far, investors reacted negatively to three: Apple AAPL, Microsoft MSFT, and Meta META. In contrast, Tesla TSLA received praise, while Alphabet GOOGL and Amazon AMZN also performed well.

This shift suggests that the group may have lost its previous market leadership role. The consistent dominance they displayed last year and early this year appears to be a thing of the past.

However, it’s important to reconsider this narrative. Most members of the Magnificent 7 continue to showcase strong growth potential.

Apple, while it seems to be transitioning away from growth, still achieved Q3 earnings of nearly $25 billion, marking an increase of +8.8% compared to last year, along with a +6.1% rise in revenues to almost $95 billion. Although it no longer matches the rapid growth rates of peers like Amazon, Alphabet, or Meta, Apple’s substantial market presence makes it difficult for competitors to challenge.

Meanwhile, Microsoft reported Q3 earnings growth of +10.7% alongside a +16% increase in revenues. Meta exceeded expectations with a +35.4% jump in earnings and a +18.9% boost in revenue, both surpassing forecasts.

Critics might point to potential slowdowns in Microsoft’s cloud services and Meta’s advertising revenues as areas of concern. But is this the primary issue with their earnings reports?

The answer lies in their preparations for an AI-driven market. Both Microsoft and Meta are making significant investments in AI infrastructure, committing funds that exceed analysts’ predictions.

This trend is not unique to them; Alphabet and Amazon are also heavily investing in AI. In contrast, Apple is somewhat behind, though it has begun to promote its AI features in upcoming software updates for new iPhones. Yet, unlike Apple, which focuses primarily on consumers, the other Magnificent 7 members aim their AI solutions mainly at businesses.

Alphabet and Amazon have effectively demonstrated the potential benefits of their AI investments during this earnings season, something Microsoft and Meta struggled to convey.

Despite this, there’s no indication that these well-managed companies are investing in risky projects. Their commitment to future growth and leadership in AI is commendable. We believe that the market’s focus on capital expenditures may be overblown.

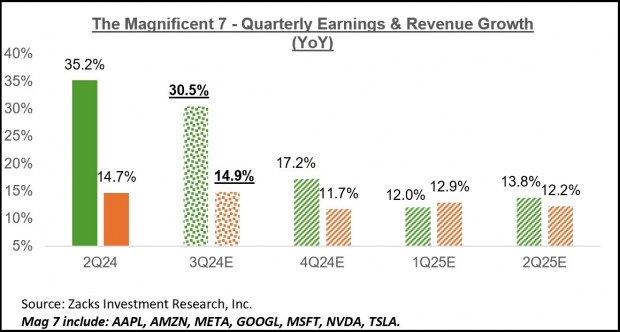

As illustrated in the chart below, the consensus expectations for the Magnificent 7 stocks showcase combined earnings growth of +30.5%, which factors in results from the six members that have already reported and estimates for Nvidia (scheduled to report on November 20th).

Image Source: Zacks Investment Research

The next chart displays the group’s earnings and revenue growth on an annual basis.

Image Source: Zacks Investment Research

Total Q3 earnings for the Technology sector are projected to rise by +19.3% year-over-year, with revenues increasing by +11.4%. It’s worth noting that without Intel’s significant losses in Q3, the sector’s earnings growth would have reached +30.5%.

The following chart illustrates the sector’s Q3 earnings and revenue growth expectations, analyzing recent quarters and future projections.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Tech sector has experienced positive revisions in growth estimates recently, especially led by the Magnificent 7 stocks.

Q3 Earnings Season Scorecard

As of Friday, November 1st, 350 S&P 500 members, or 70% of the index, have reported their Q3 results. With 104 more companies set to report this week, we expect to see results from over 90% of the index’s members.

The total earnings from these 350 companies have risen by +8.8% from the same period last year, accompanied by a +5.7% increase in revenues. About 74.9% of these companies exceeded EPS estimates, while 60.6% beat revenue estimates.

Half of the 350 index members reported both EPS and revenue beats.

To provide further perspective, the following charts compare Q3 earnings and revenue growth rates in historical context.

Image Source: Zacks Investment Research

The next set of charts visually compares the Q3 EPS and revenue beats percentages within a historical framework.

Image Source: Zacks Investment Research

The following charts highlight revenue performance and the ratio of blended beats for these 350 index members.

Image Source: Zacks Investment Research

Overall, the growth trend appears stable and encouraging. However, a lower number of companies exceeded consensus estimates compared to more recent periods. Both EPS and revenue beating percentages are currently below the levels seen over the last 20 quarters.

Q3 Earnings Show Mixed Results Among S&P 500 Companies

Summary of Earnings Performance

The overall earnings landscape for Q3 reveals that total earnings for the S&P 500 index are anticipated to increase by +6.8% year over year, driven by a revenue rise of +5.4%. This analysis takes into account the companies that have released results as well as estimates for those yet to report.

Image Source: Zacks Investment Research

Sector Contributions to Earnings Growth

When examining the sectors, the Energy industry is dampening the overall earnings growth, while Technology is providing a significant boost. Without the Energy sector’s negative impact, Q3 earnings for the S&P 500 would have surged by +9.2%. If we exclude the Tech sector’s strong performance, earnings growth across the rest of the index would show only a modest +2% gain.

Excluding the contributions from the group known as the Magnificent Seven, earnings for the remaining 493 S&P 500 members would reflect a mere +1.3% increase instead of the expected +6.8% growth.

Expectations for Q4 and Beyond

Looking ahead to Q4 2024, total earnings for the S&P 500 are projected to climb by +7.7% compared to the same quarter last year, accompanied by +4.4% higher revenues. Unlike the significant estimate reductions seen prior to Q3, projections for Q4 have remained more stable, demonstrating stronger resilience.

Image Source: Zacks Investment Research

A Look at Long-Term Earnings Trends

The historical earnings picture is also revealing. This year is set to see a +7.5% growth in earnings, with projections suggesting that double-digit increases are likely in 2025 and 2026.

Image Source: Zacks Investment Research

This year’s earnings growth re-calculates to +9.5% when excluding the Energy sector’s underperformance.

For a detailed analysis of earnings trends and future expectations, refer to our weekly Earnings Trends report >>>>Tech Flexes Earnings Power: A Closer Look

Zacks Research Unveils Promising Stock Pick

Our team has identified five stocks with a high potential for gains exceeding +100% in the near future. Notably, Sheraz Mian, the Director of Research, has spotlighted one stock that he believes has the greatest likelihood of outperforming the others.

This standout choice is part of an innovative financial services firm that boasts a rapidly expanding customer base, now exceeding 50 million, and offers a wide range of cutting-edge solutions. While not every investment succeeds, this pick has the potential to far exceed previous top performers such as Nano-X Imaging, which saw a remarkable +129.6% gain within nine months.

Free: Discover Our Top Stock Plus 4 Additional Picks

Stay updated on the latest recommendations from Zacks Investment Research. Today, you can download the report on 5 Stocks Set to Double. Click to obtain your free copy.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.