“`html

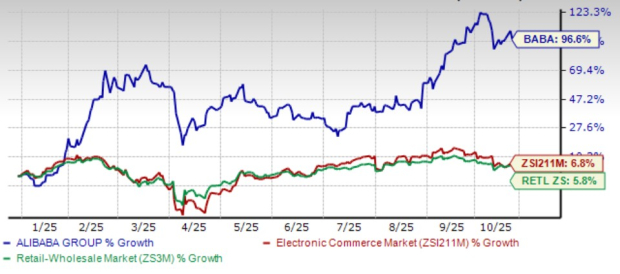

Alibaba Group (BABA) reported a negative free cash flow of RMB 18.8 billion in Q1 of fiscal 2026, compared to a positive inflow in the same period last year, as capital expenditures surged to RMB 38.7 billion. These expenditures are aimed at scaling AI, cloud infrastructure, and expanding Taobao Instant Commerce. The company reiterated a three-year investment plan of RMB 380 billion (approximately $53 billion) for AI and cloud initiatives at the Apsara 2025 Conference, indicating ongoing pressure on free cash flow.

Despite leading China’s AI cloud market with a 35.8% share, Alibaba faces intense competition from companies like Pinduoduo and ByteDance, prompting continued high levels of investment. The forecast also indicates a 4.7% revenue gain for fiscal 2026 and an 11.3% increase for fiscal 2027, although these gains come amid sustained pressures from heavy investment costs.

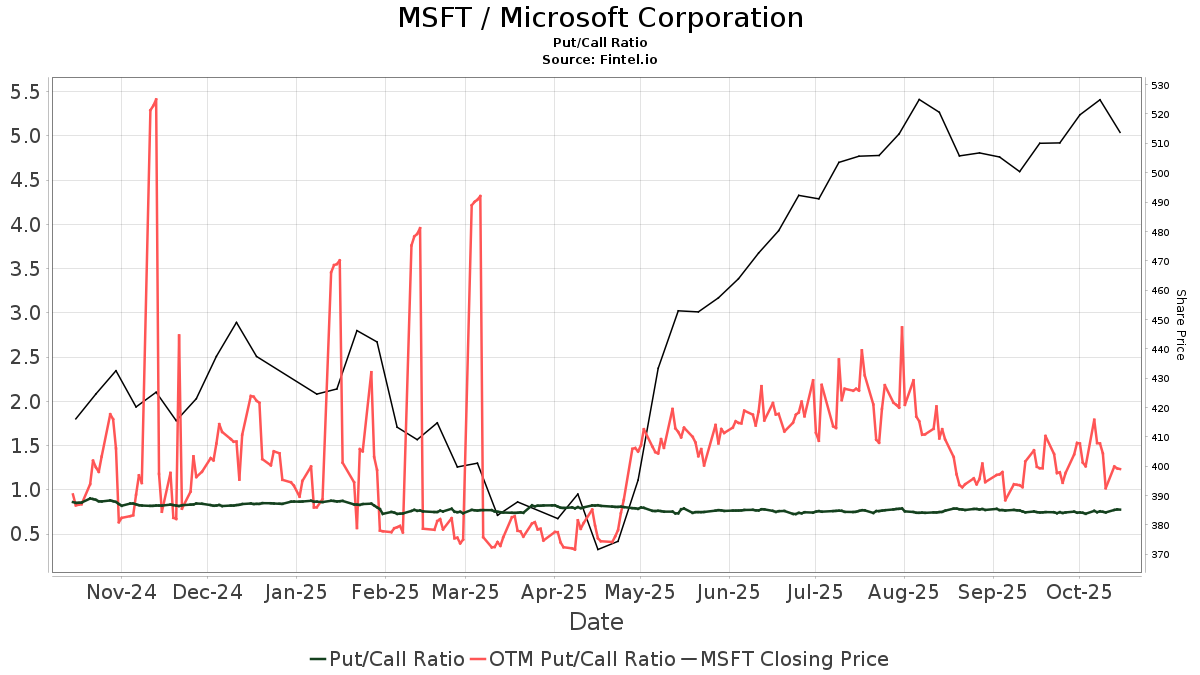

In comparison, Amazon is set to exceed $118 billion in capital expenditure for 2025 to bolster its global AI and cloud capabilities, while Microsoft plans over $80 billion in capex for the same year, primarily targeting AI-driven data centers and Azure cloud expansion.

“`