Nvidia’s Warning Causes Quantum Stock Plunge

Recent comments from Nvidia Corp CEO Jensen Huang have sent tremors through the quantum computing market. Speaking at the company’s Analyst Day, Huang predicted that “very useful” quantum computers may not appear for another 15 to 30 years.

Stocks Crash Following Cautionary Tale

This statement hit the quantum computing sector hard, leading to a significant drop in stocks that had previously been buoyed by speculation. Shares of key players such as IonQ Inc IONQ, Rigetti Computing Inc RGTI, and D-Wave Quantum Inc. QBTS plummeted by as much as 40% in mere days. Just a year ago, these companies were riding high: IonQ had soared by 129% while Rigetti saw an astounding 828% increase.

Breaking Down Individual Stocks

IonQ

IonQ’s stock has taken a nearly 30% hit as a result of Huang’s remarks. Despite this downturn, the stock appears to be stabilizing above significant moving averages, indicating potential for recovery. Its eight-day simple moving average (SMA) is at $43.76, hinting at a bounce-back possibility, while the 200-day SMA at $14.33 also offers a positive signal. However, the stock faces selling pressure and remains below its eight, 20, and 50-day SMAs. The relative strength index (RSI) stands at 39.05, meaning it’s not yet oversold.

Rigetti Computing

For Rigetti, the situation is similarly grim, with a 35% decline in just five days. Nevertheless, the stock’s indicators still reflect some strength. The eight-day SMA is at $16.98, and the 20-day SMA is at $12.39, implying a rebound opportunity. The RSI is neutral at 46.58, while the moving average convergence/divergence (MACD) indicates bullish strength at 3.22. If the quantum sector experiences a revival, Rigetti might catch investor interest again.

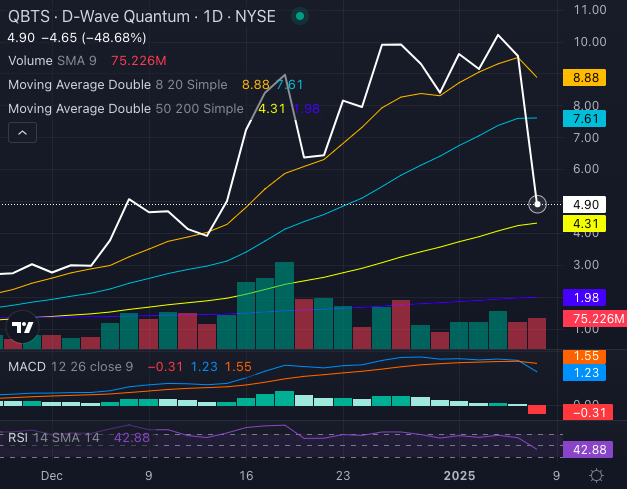

D-Wave Quantum

D-Wave Quantum’s stock was not spared; it suffered a staggering 40% decline. However, some technical indicators remain encouraging. Its eight-day SMA is at $8.88 and the 20-day SMA at $7.61, both signaling potential buying interest. The RSI of 42.88 shows relative stability in trading sentiment, suggesting neither a sell nor a buy extreme, and a positive MACD of 1.23 implies resilience despite recent losses.

Conclusion: Cautious Optimism Ahead

Despite Huang’s sobering outlook shaking the momentum of these quantum stocks, the technical indicators suggest that they may still present buying opportunities in the future. Should market sentiment shift positively or unexpected advancements in quantum technology emerge, these stocks could recover. Until then, investors may want to remain patient as the quantum computing landscape evolves.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs