Super Micro Seeks Recovery Amidst Allegations and a New Stock Split

Earlier this year, Super Micro Computer, Inc. (SMCI) was in a prime position, thriving on high demand for its server solutions related to the artificial intelligence surge. Investors were eager to invest in companies linked to this trend, and SMCI was a standout choice.

Super Micro stands out for its high-performance, liquid-cooled servers, specifically designed to handle the demanding workloads generated by NVIDIA Corporation’s (NVDA) powerful GPUs. This advantage placed Super Micro well ahead of its competitors.

As a result, SMCI’s stock skyrocketed by 332%, reaching a record high of $1,229 by March. It remained one of the top-performing stocks at the start of 2024.

However, the stock has recently faced significant challenges due to persistent bad news, including severe allegations from a noted short seller and a Department of Justice investigation.

In this edition of Market 360, we will explore the allegations and the ensuing investigation SMCI is undergoing. We’ll also examine the potential recourse that could lead to a rebound in the stock price and whether SMCI is a wise investment currently. Lastly, I will highlight another AI stock poised for growth following a major event hosted by Elon Musk next week.

Understanding Super Micro’s Recent Troubles

On August 26, Hindenberg Research, a well-known short seller, released a report that accused Super Micro of accounting violations based on claims from a former disgruntled employee. This revelation caused shares to drop by 8%, although the stock partially rebounded shortly after.

Just two days later, SMCI announced a delay in filing its annual 10-K report, which triggered a further 20% drop in stock price.

Then, on September 24, The Wall Street Journal reported that the Department of Justice (DOJ) was investigating Super Micro’s accounting in response to the Hindenberg report.

To summarize, these significant drops stem from a whistleblower lawsuit by a former employee, and Hindenberg Research’s allegations that have severely impacted SMCI shares. The firm is known for its tactics of causing stock declines for profit, and this incident reflects its methods.

It’s important to note that the timing of Hindenberg’s report came during a month when trading activity is typically lower, making it easier for the stock to decline. I personally believe the allegations lack credible proof, but we will await the DOJ’s findings. Unfortunately, Super Micro finds itself caught in a storm of unfair accusations and market volatility.

Despite these challenges, Super Micro boasts strong forecasts for sales and earnings growth. This has led some investors to consider the idea of buying SMCI while prices are low, especially since a significant event is on the horizon.

This event is the company’s 10-for-1 stock split, which took effect on October 1.

The Significance of a Stock Split

A stock split occurs when a company divides its existing shares into smaller pieces. While this process changes the number of shares owned, it does not affect the company’s fundamental value.

For example, suppose you owned 10 shares of Super Micro before the split. After the split, you would have 100 shares, as each share was divided into ten. Importantly, the overall value remains unchanged, as a stock split does not alter gains or losses.

The primary intention behind a stock split is to make shares more affordable, appealing to individual investors. Many may feel reluctant to invest in a stock priced above $1,000, as purchasing several shares can lead to disproportionate portfolio allocation.

As they say, perception matters. A lower share price can present the stock as more accessible to everyday investors. Additionally, stocks often see a boost following a split due to increased investor interest.

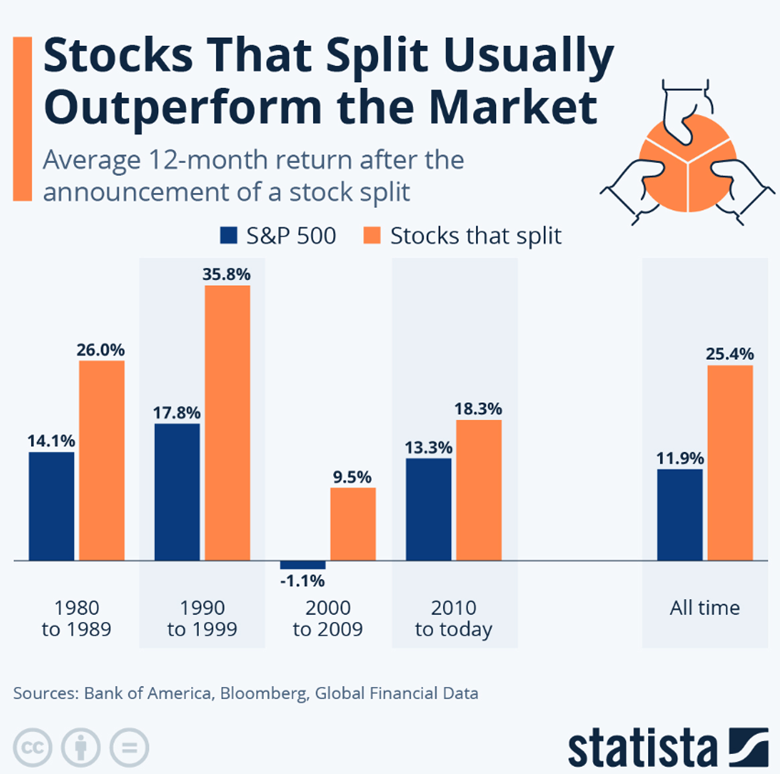

For instance, Bank of America’s Research Investment Committee noted that stocks that split have historically outperformed, gaining an average of 25.4% in the year after a split compared to the S&P 500’s 11.9% return. This trend underscores the potential benefits of stock splits.

Source: Statista

Should You Invest in SMCI?

With SMCI’s recent stock split and promising financials, now may be an appropriate time to consider investing in the company. Let’s take a look at the insights provided by my Stock Grader (subscription required).

Super Micro Receives Mixed Grades Amid Anticipated Earnings Report

Current Grades Signal Caution

Super Micro Computer, or SMCI, has been assigned a Fundamental Grade of C by Stock Grader, which indicates a Hold recommendation. This grade reflects the company’s recent struggles with margin compression and an inability to meet analysts’ high expectations.

In addition to the Fundamental Grade, Super Micro also holds a Quantitative Grade of C. This suggests a slowdown in buying interest from institutional investors, including hedge funds and pension funds.

Overall, Stock Grader gives Super Micro a Total Grade of C, which further emphasizes its Hold position.

Understanding the Implications

For investors, this means that while it’s not advisable to buy SMCI right now, it may also not be a good time to sell if you currently own shares.

Looking ahead, Super Micro is scheduled to release its quarterly earnings on November 6. Analysts predict that earnings will rise more than 100% year-over-year to $7.51 per share, up from $3.43 per share from the same quarter last year. Furthermore, revenue forecasts predict a staggering increase of 212.8% year-over-year, reaching $6.46 billion.

If Super Micro can surpass these analysts’ expectations and offer positive future guidance, a notable stock rebound could be expected.

A Pivotal Moment for AI Innovations

I have followed Super Micro Computer closely and recommend it through my various advisory services. The company remains a key player in the ongoing AI revolution.

While awaiting the stock’s recovery, an exciting development in AI is on the horizon. Elon Musk is set to unveil his long-awaited “Robotaxi” on October 10.

Although self-driving cars have been a cornerstone of Musk’s ambitious plans, progress has been limited. Nevertheless, my colleague Luke Lango has identified a lesser-known supplier likely to play a crucial role in this venture.

This is a unique opportunity to invest early in what could become one of Musk’s significant innovations.

On Monday, October 7, at 10 a.m. Eastern, Luke will host a broadcast to share essential insights about this topic.

Don’t miss the chance to stay informed.

Click here to sign up and secure your spot for Luke’s upcoming event!

Sincerely,

Louis Navellier

Editor, Market 360