Understanding Wall Street’s Views on BigBear.ai: A Deep Dive into Broker Recommendations

Before making a decision to Buy, Sell, or Hold, investors often look to Wall Street analysts. But how much weight should you place on their recommendations when deciding on stocks?

Let’s take a closer look at what analysts are saying about BigBear.ai Holdings, Inc. (BBAI), and explore the reliability of brokerage recommendations.

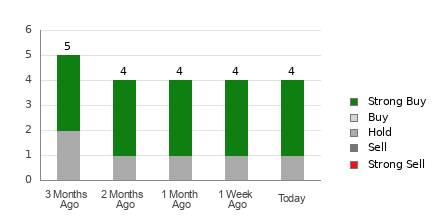

BigBear.ai holds an average brokerage recommendation (ABR) of 1.50, on a scale from 1 to 5, where 1 denotes Strong Buy and 5 denotes Strong Sell. This rating is based on recommendations from four brokerage firms. An ABR of 1.50 suggests a general consensus leaning towards Strong Buy.

Out of the four recommendations that contribute to this ABR, three suggest Strong Buy, accounting for 75% of total recommendations.

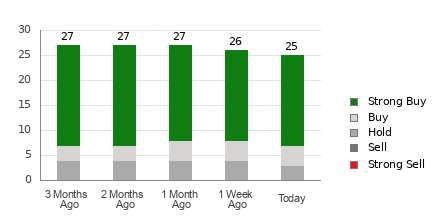

Recent Trends in Brokerage Recommendations for BBAI

Explore price targets & stock forecasts for BigBear.ai here>>>

Despite the favorable ABR, investing solely based on this rating may not be wise. Studies reveal that brokerage recommendations often fall short of successfully leading investors to stocks poised for price increases.

Why is this the case? Brokerage firms typically have vested interests in the stocks they cover, which can bias their analysts toward overly positive recommendations. Research shows that for every “Strong Sell” rating, there are approximately five “Strong Buy” recommendations.

In essence, analysts’ ratings may not accurately reflect a stock’s future price trajectory. It’s advisable to use these ratings to reinforce your own research rather than rely on them fully.

One alternative is the Zacks Rank, a proprietary stock rating system with a solid track record for accurately predicting stock performance. This system categorizes stocks into five groups, running from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), based on earnings estimate revisions.

Distinguishing Between Zacks Rank and ABR

Although both the Zacks Rank and ABR are represented on a similar numerical scale, their foundations are different.

The ABR is derived solely from broker recommendations, which are typically shown in decimals. Conversely, Zacks Rank utilizes a quantitative model based on earnings estimate revisions, represented by whole numbers.

Historically, brokerage analysts maintain a tendency to issue more optimistic ratings than their research supports, often misguiding investors.

On the other hand, the Zacks Rank is grounded in earnings estimate trends, which empirical research correlates closely with short-term stock price movements.

The Zacks Rank also ensures a balanced application across all stocks for which brokers provide earnings estimates. This approach clarifies that the ratings remain proportionate, maintaining balance among the five ranks.

Another notable difference lies in how timely the ratings are. The ABR may not reflect the latest insights, while earnings estimates are frequently updated, allowing the Zacks Rank to offer a more current predictor of stock performance.

Should You Consider Investing in BBAI?

For BigBear.ai, the Zacks Consensus Estimate remains steady at -$0.79 over the past month.

The lack of change in analysts’ earnings expectations might indicate the stock will perform in line with broader market trends in the near term.

Taking into account the unchanged consensus estimate along with other factors, BigBear.ai has acquired a Zacks Rank #3 (Hold). You can review today’s Zacks Rank #1 (Strong Buy) stocks here >>>>.

It might be wise to approach the Buy recommendation for BigBear.ai with caution.

Expert Selections for Strong Growth Potential

Among thousands of stocks, five Zacks experts have chosen their top picks expected to rise +100% or more in the upcoming months. From this selection, Research Director Sheraz Mian has identified the one with the most explosive potential.

This particular company targets millennial and Gen Z customers, achieving nearly $1 billion in revenue last quarter. A recent decline in its stock price may present a compelling buying opportunity. While not all picks achieve success, this choice could significantly outperform earlier Zacks suggestions like Nano-X Imaging, which gained +129.6% in just over nine months.

Free: Discover Our Top Stock and Four Contenders

Access a free stock analysis report for BigBear.ai Holdings, Inc. (BBAI).

Read the full article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.