Note: This is a summary of this week’s Earnings Trends report. For comprehensive historical data and future estimates, please click here>>>

Key Highlights of Q3 Earnings

- The total earnings for Q3 among 399 S&P 500 companies reporting by Wednesday, November 6th, increased by +6.9%, with revenues climbing +5.2%. Notably, 73.9% of companies surpassed earnings per share (EPS) forecasts, while 61.4% exceeded revenue projections.

- Following modest growth in Q3, earnings growth is expected to pick up, with three of the next four quarters projected to show double-digit increases.

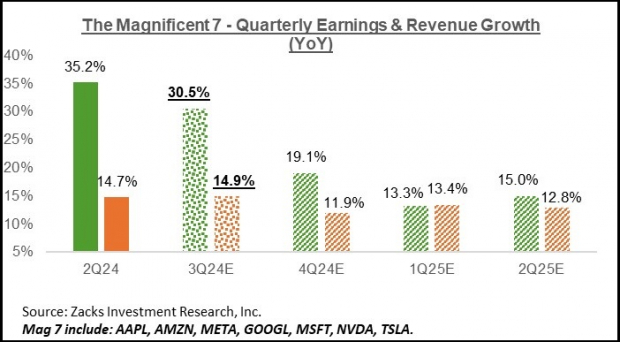

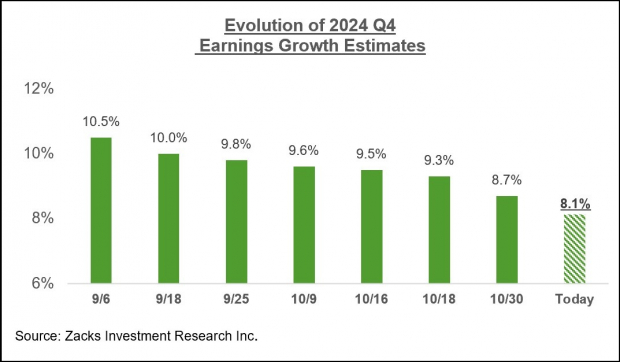

- For Q4 2024, the total earnings for the S&P 500 are anticipated to rise +8.1% year-over-year, driven by +4.9% higher revenues. Without the downturn in the Energy sector, earnings growth for the rest of the index would reach +10.0%.

- Forecasts for Q4 of 2024 have seen a slight decline, dropping from +9.8% at the start of October to +8.1% today. This decrease is less severe than declines seen in prior quarters.

Nvidia and the Magnificent 7: Driving Earnings Growth

Nvidia NVDA remains the only company in the Magnificent 7 group yet to announce its Q3 results. As a leading player in the AI sector, Nvidia is set to report on November 20th, and estimates suggest earnings will surge by +81.9% year-over-year, with revenues climbing +81.1%.

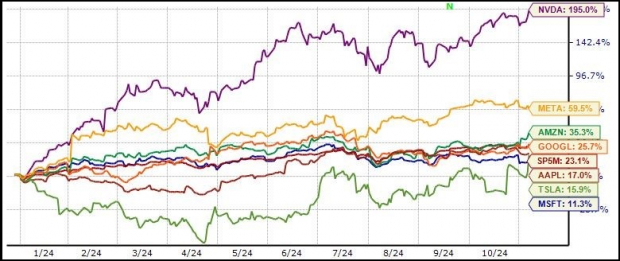

In 2023, Nvidia’s stock performance has been remarkable, soaring over +190% this year, significantly outpacing its peers in the Magnificent 7 and the overall technology sector. This trend highlights Nvidia’s pivotal role in the ongoing AI revolution.

Image Source: Zacks Investment Research

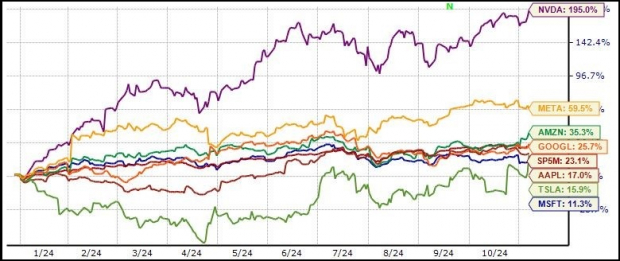

Despite challenges affecting some Magnificent 7 stocks, their collective earnings growth remains robust. These seven companies are projected to earn $126.2 billion in Q3, alongside revenues of $492.5 billion, reflecting a year-over-year earnings growth of +30.5% on +14.9% higher revenues.

Image Source: Zacks Investment Research

These seven firms represent 23.1% of total S&P 500 earnings. Without their significant contributions, earnings for the broader index would only grow by +1.1% this quarter.

Overview of Q3 Earnings

In total, when combining reported results with remaining estimates, S&P 500 earnings for Q3 are now expected to rise by +6.7% compared to last year, supported by +5.4% higher revenues. If not for the struggling Energy sector, which saw a -24.2% decline, overall earnings growth would improve to +9.1%. Conversely, excluding gains from the technology sector, total earnings growth would only be +1.8%.

Looking ahead to 2024 Q4, S&P 500 earnings are projected to increase by +8.1% with +4.9% rise in revenues. Earnings would improve to +10.0% without the drag from the Energy sector.

Although estimates have slightly reduced since the beginning of the quarter, the extent of these revisions has been less severe than in previous quarters. The upcoming charts detail how earnings estimates for Q4 have evolved in recent weeks.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

This year’s earnings growth of +7.9% came with a modest +1.9% revenue rise, primarily due to challenges in the Finance sector. Excluding Finance, earnings growth stands at +7.1% and revenue growth improves to +4.2%. In essence, around half of this year’s earnings growth is derived from revenue increases, with margin improvements contributing the rest.

Zacks Identifies Top Semiconductor Stock

Our new recommended semiconductor stock is just 1/9,000th the size of NVIDIA, which has surged more than +800% since its recommendation. While NVIDIA remains strong, this emerging chip stock holds greater potential for growth.

With impressive earnings growth and an expanding customer base, this company is well-positioned to meet the soaring demand for AI, Machine Learning, and IoT. The global semiconductor market is projected to grow from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

For the latest recommendations from Zacks Investment Research, download “5 Stocks Set to Double” for free. Click to get this report.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

To read the complete article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.