MP Materials (MP) and Lynas Rare Earths Limited (LYSDY) are leading players in the global rare earth supply chain, essential for high-performance magnets in electric vehicles, defense, and technology. As of 2025, MP has a market capitalization of $11.8 billion and is the only fully integrated rare earth producer in the U.S., while Perth-based Lynas is valued at $11.5 billion, focused on mining and processing rare earth minerals in Australia and Malaysia. With nearly 70% of global rare earth mining controlled by China, both companies are pivotal in reducing reliance on Chinese supply amidst escalating U.S.-China tensions.

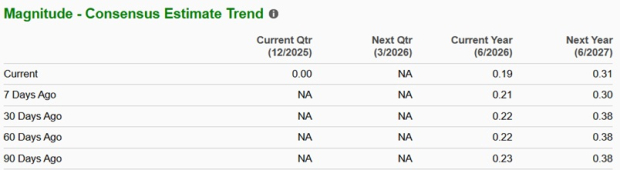

In the third quarter of 2025, MP reported revenues of $56.6 million, a 15% decline from the previous year, while annual production surged to a record 721 metric tons of NdPr. Conversely, Lynas has successfully started commercial production of separated Heavy Rare Earths outside China for the first time in decades, and its fiscal 2026 earnings are projected at 19 cents per share, notably up from a mere one cent in fiscal 2025.

Investors are closely watching the earnings estimates for both companies; MP’s fiscal 2025 estimates show an anticipated loss of 32 cents per share, with a potential rebound to earnings of 61 cents in fiscal 2026. In contrast, Lynas continues to show stronger growth prospects and has outperformed MP in stock gains over the past year, making it a more compelling buy for investors aiming for exposure in the rare earths market.