Wall Street Analysts’ Recommendations on GE Vernova: What Investors Should Know

Investors often turn to Wall Street analysts for guidance on whether to buy, sell, or hold a stock. Changes in recommendations from sell-side analysts frequently influence stock prices. But do their insights hold real value?

Let’s delve into the perspective of these analysts on GE Vernova (GEV) and assess the reliability of their recommendations to inform your investment strategies.

Current Analyst Recommendations for GE Vernova (GEV)

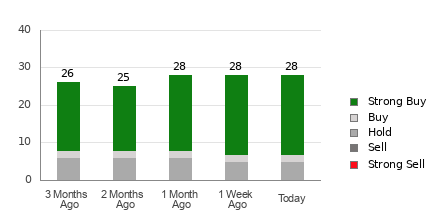

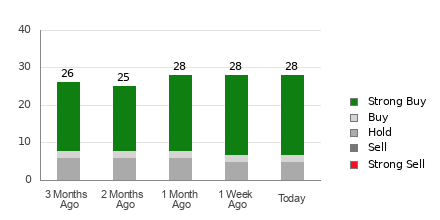

GE Vernova boasts an average brokerage recommendation (ABR) of 1.41, on a scale from 1 to 5, where 1 is a Strong Buy and 5 is a Strong Sell. This ABR is based on 28 recommendations from various brokerage firms. Essentially, an ABR of 1.41 indicates a consensus leaning between Strong Buy and Buy.

From the 28 recommendations that contribute to the current ABR, 21 classify as Strong Buy, while 2 are categorized as Buy. Correspondingly, Strong Buy and Buy comprise 75% and 7.1% of all ratings.

Check price target & stock forecast for GE Vernova here>>>

Understanding Brokerage Recommendations

While the ABR for GE Vernova suggests a buying opportunity, it’s unwise to base any investment decision on this data alone. Research indicates limited effectiveness of brokerage recommendations in identifying stocks likely to appreciate significantly.

One reason for this skepticism is the inherent bias at brokerage firms. Analysts often favor positive ratings to support interests of their firms. Our findings reveal a concerning ratio: for every “Strong Sell” rating, brokers provide five “Strong Buy” recommendations.

This discrepancy raises questions about their alignment with retail investors. Therefore, one of the best uses of this information is to validate your own research or to enhance indicators with a proven track record for predicting price movements.

Comparing Zacks Rank and Brokerage Recommendations

Zacks Rank, our proprietary stock rating system, assigns ratings from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This model has shown to be reliable in forecasting a stock’s near-term price performance, making it a practical tool for investment decisions.

Despite both Zacks Rank and ABR being displayed on a 1 to 5 scale, they are fundamentally different. The ABR is derived solely from brokerage recommendations and typically presented in decimals (like 1.28). In contrast, the Zacks Rank is built on earnings estimate revisions and is shown in whole numbers.

Brokerage analysts have a track record of being overly optimistic. Their ratings often reflect more favorable assessments than warranted by the actual research, which can mislead investors.

Conversely, the Zacks Rank is closely tied to earnings estimate revisions. Empirical studies link short-term stock price changes with earnings estimate trends, providing a more reliable predictive gauge.

Investment Potential for GE Vernova

Looking specifically at GE Vernova, the Zacks Consensus Estimate for the current year has seen a rise of 3.1% in the past month, now standing at $6.53. This increase in forecasts reflects growing analyst confidence in the company’s earnings potential, suggesting that a stock price surge may be on the horizon.

The substantial adjustment in the consensus estimate, combined with additional factors, has boosted GE Vernova to a Zacks Rank #2 (Buy). You can find the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

Thus, while the Buy-equivalent ABR for GE Vernova can provide useful insights, it’s wise to consider it alongside other analyses.

Discover 5 Stocks Poised for Significant Growth

We highlight five stocks identified by Zacks experts as top candidates for potentially doubling in value during 2024. Though not all predictions will pan out, previous selections have delivered impressive gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Many stocks highlighted in this report remain under Wall Street’s radar, offering a prime opportunity to invest early.

See These 5 Potential Home Runs Today >>

Get Your Free Stock Analysis Report on GE Vernova Inc. (GEV)

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.