Amazon Faces Investor Concerns Amid AI Spending Surge

Shares of Amazon (NASDAQ: AMZN) fell by 10.7% in February, as reported by S&P Global Market Intelligence. Despite the company reporting strong financial results for 2024 on February 6 that surpassed expectations, investors expressed apprehension about an upcoming $100 billion expenditure.

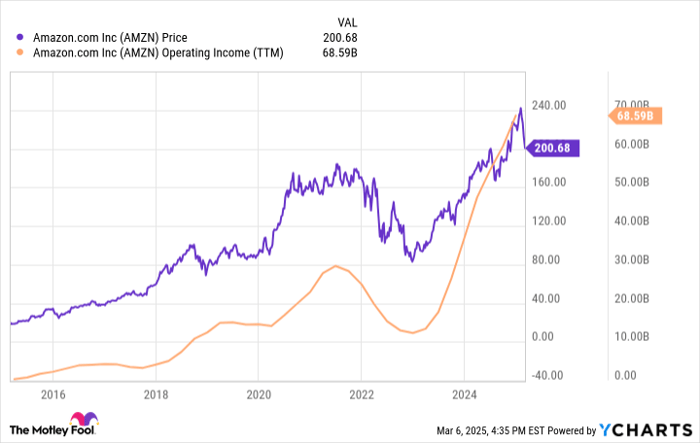

To put this in perspective, Amazon concluded a remarkable year. The company achieved a record operating income of $68.6 billion, marking an 86% increase from the previous year, nearly matching the total for the last three years combined. The standout performer was Amazon Web Services (AWS), which generated over half of the operating income for the year, with net sales growing by 19% to surpass $100 billion.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

It’s important to clarify that AWS remains a crucial player in the cloud-computing sector, showing exceptional growth for many years. Recently, the industry has gained momentum due to rising interest in artificial intelligence (AI). This has led enterprises to increasingly rely on AWS for experimentation and implementation of AI applications.

To cater to this growing demand, Amazon plans significant investments to enhance its computing capabilities. Company leadership forecasts capital expenditures (capex) to reach $100 billion for 2025, with CEO Andy Jassy stating, “The vast majority of that capex spend is on AI for AWS.”

A Look at Amazon’s AI Spending and Its Impact on Profits

While it is difficult to predict investor sentiment, I was surprised that Amazon’s capex guidance sparked concern. Historical expenditure has risen sharply; the company invested $48.1 billion and $77.7 billion in capex during 2023 and 2024, respectively. A jump to over $100 billion is a significant increase. Concerns may arise from instances where excessive AI spending has negatively affected profit margins.

There is some merit to investors’ worries here. Management anticipates a decline of $700 million in full-year operating income for 2025 compared to 2024. As illustrated in the chart below, Amazon’s stock typically experiences declines during periods of falling operating income.

AMZN data by YCharts.

Amazon’s Strategic Capex Investments

Investors should maintain perspective. Amazon’s expected 1% drop in operating income reflects its commitment to enhancing AI capabilities, which still positions 2025 as its second most profitable year to date.

Moreover, Amazon faces a pressing need to invest in this area. AWS is large and continues to expand. Cloud customers increasingly demand AI functionalities. For Amazon to sustain the growth of AWS, it must deliver these essential services. Hence, the necessary capex spending is pivotal for maintaining its competitive edge.

Finally, if any company can sustain such investments, it is Amazon. The company allocated nearly $78 billion for capex in 2024, resulting in a remaining free cash flow of $38 billion. This financial flexibility positions Amazon well as it continues to develop AWS.

Your Opportunity to Invest Wisely

Ever feel like you missed out on investing in high-performing stocks? Now is your prime opportunity.

Our expert analysts occasionally issue a “Double Down” Stock recommendation for companies projected to perform well soon. If you have concerns about having missed past investment chances, now is the optimal time to buy before it becomes too late. Consider the compelling figures:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $304,161!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $44,694!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $534,395!*

Currently, we’re making “Double Down” alerts for three outstanding companies, and this opportunity may not come again soon.

Continue »

*Stock Advisor returns as of March 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is on The Motley Fool’s board of directors. Jon Quast does not hold any positions in the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool’s disclosure policy is available for review.

The views and opinions expressed herein reflect those of the author and do not necessarily align with those of Nasdaq, Inc.