Evaluating Wall Street’s Take on TJX: What Investors Need to Know

Wall Street analysts’ opinions can heavily influence investor decisions regarding stock transactions. Changes in ratings by brokerage analysts can lead to notable shifts in a stock’s price. But do these recommendations actually matter?

In this analysis, we will focus on TJX TJX and assess the reliability of brokerage recommendations while offering ways to use this information effectively.

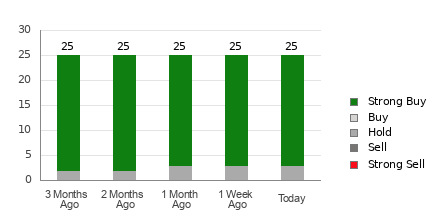

The current average brokerage recommendation (ABR) for TJX stands at 1.24 on a scale from 1 to 5, where 1 signifies a Strong Buy and 5 indicates a Strong Sell. This figure derives from the ratings provided by 25 brokerage firms. An ABR of 1.24 suggests a consensus leaning towards a Strong Buy.

Of the 25 recommendations contributing to this ABR, 22 are categorized as Strong Buy, making up 88% of the total.

Current Trends in Brokerage Recommendations for TJX

Despite the strong recommendation to buy TJX, relying on this indication alone for investment decisions may not be wise. Research indicates that brokerage recommendations often fail to reliably guide investors towards stocks likely to appreciate significantly in price.

But why is that the case? Brokerage firms typically have vested interests in the stocks they cover, which can skew analysts’ ratings towards more positive assessments. For each “Strong Sell” rating, there exist approximately five “Strong Buy” ratings, revealing potential biases in their outlooks.

Thus, these recommendations might not always align with retail investors’ interests, often obscuring a stock’s true potential trajectory. Therefore, it may be beneficial to use these insights to support independent research or to validate other analytic tools proven effective in tracking stock movements.

One such tool doing well in this regard is the Zacks Rank. This system ranks stocks from #1 (Strong Buy) to #5 (Strong Sell), based on a detailed analysis of various factors, including earnings estimate revisions. Validating brokerage insights with the Zacks Rank can significantly enhance investment decisions.

Understanding the Difference: ABR vs. Zacks Rank

Although both the ABR and Zacks Rank use a 1 to 5 scale, they measure different aspects. The ABR is based solely on actual brokerage recommendations and is often expressed in decimals (for example, 1.28). Conversely, the Zacks Rank is a quantitative ranking that focuses on earnings estimate revisions and is presented in whole numbers from 1 to 5.

Brokerage analysts often exhibit an overly optimistic stance in their ratings, driven by their employers’ interests. This trend can lead to more favorable ratings than warranted by the actual research, frequently leading investors astray.

In contrast, the Zacks Rank directly correlates to earnings estimate revisions, which are well-researched indicators of short-term stock performance. Moreover, the Zacks Rank maintains proportional representation among all stocks analyzed for earnings estimates in the current year.

Another key distinction lies in timeliness. The ABR may not always reflect the most current information. In contrast, due to the nature of how earnings estimates are updated, the Zacks Rank quickly adapts to reflect shifts in business dynamics, enhancing its utility in forecasting stock price movements.

Investment Outlook for TJX

Regarding TJX, the Zacks Consensus Estimate for the current year remains firm at $4.15 over the past month.

Analysts’ consistent outlook on the company’s earnings prospects—demonstrated by the unchanged consensus estimate—suggests that TJX is likely to perform in line with the overall market in the near future.

The consistent consensus estimate, along with three other factors evaluating earnings revisions, has placed TJX at a Zacks Rank of #3 (Hold).

Given these insights, caution may be advisable despite the Buy-like ABR for TJX.

To access the full article on Zacks.com, click here.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.