Market Volatility: Understanding the Recent Stock Decline

Despite being the top-performing asset class over the last century, the stock market does not always navigate from Point A to Point B smoothly. Recent weeks exemplify this reality. Since reaching an all-time closing high on February 19, the broad S&P 500 (SNPINDEX: ^GSPC), the venerable Dow Jones Industrial Average (DJINDICES: ^DJI), and the tech-heavy Nasdaq Composite (NASDAQINDEX: ^IXIC) have seen declines of 15.6%, 18.9%, and 23.9%, respectively, through April 8. The Dow and S&P 500 are now in correction territory, while the Nasdaq is experiencing its first bear market since 2022.

Considering where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy at this moment. Learn More »

Analyzing Market Movements in Turbulent Times

As uncertainty grips Wall Street, many investors turn to historical data and metrics for insights into market directions. While no single indicator can predict future movements with absolute certainty, a few have shown strong correlations with stock trajectory in the past. Notably, the closing value of the CBOE S&P 500 Volatility Index (VOLATILITYINDICES: ^VIX), commonly referred to as the “VIX,” has accurately forecasted future market behavior for 35 years.

Image source: Getty Images.

Two Key Factors Behind the Stock Market Decline

Market corrections can occur smoothly or abruptly. The recent downturn resembles the latter, as evidenced by significant losses exhibited in just a few days. Between April 3 and April 4, the S&P 500 fell by 10.5%, while the Dow Jones Industrial Average declined by more than 10% (4,580 points) within just four trading sessions (April 3 to April 8). The current stock market scenario reflects the definition of a crash, largely driven by two primary factors.

First, concerns regarding President Donald Trump’s extensive tariff policy, dubbed “Liberation Day” for America, have escalated. On April 2, he announced a global 10% tariff and additional “reciprocal tariffs” on select countries with unfavorable trade balances with the U.S. These tariffs could spark a trade war with China or exacerbate tensions with U.S. allies. Moreover, indiscriminate tariffs threaten to reignite inflation and stall economic growth. According to the Federal Reserve Bank of Atlanta’s GDPNow model on April 3, there could be a projected 2.8% contraction in U.S. GDP for the first quarter.

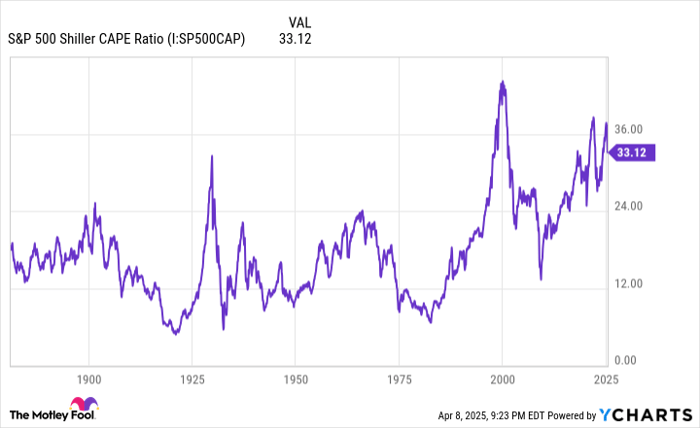

The second contributing factor to the market downturn is the historically high valuations of equities.

S&P 500 Shiller CAPE Ratio data by YCharts.

In December 2024, the S&P 500’s Shiller price-to-earnings (P/E) Ratio, also known as the cyclically adjusted P/E Ratio (CAPE Ratio), reached a peak of 38.89 during the ongoing bull market. This figure more than doubles the average Shiller P/E ratio of 17.23, when back-tested to January 1871. Over the 154-year history of the Shiller P/E, there have only been six periods where it remained above 30 for at least two months, which includes the current situation. Although the Shiller P/E is not a definitive predictor of when stocks will decline, every instance of it exceeding 30 has preceded significant declines of 20% or more in major indices like the Dow, S&P 500, or Nasdaq Composite.

Even amidst the recent crash, the S&P 500’s Shiller P/E stood at 30.74 on April 8, indicating that valuations remain historically elevated and suggesting further downside may be imminent.

Image source: Getty Images.

VIX’s Accuracy in Projecting Market Movements

Understanding the factors that contributed to the stock market decline sets the stage for discussing the CBOE Volatility Index. The VIX, developed by the Chicago Board of Options Exchange, gauges the market’s expected volatility based on S&P 500 index options prices over the next 30 days.

When the VIX registers a low reading between 10 and 20, it implies investors anticipate minimal volatility in the near term. Conversely, a reading above 30 often indicates elevated investor anxiety and uncertainty, leading to potential volatility. Following the recent crash, the VIX closed at 45.3 on April 4, and as of April 8, the index surged to over 52.

Data compiled by Creative Planning’s Chief Market Strategist, Charlie Bilello, reveals that last week marked the 21st instance since 1990 where the VIX closed a week above 45.

The $VIX ended the week at 45.3, among the highest weekly closes in history.

# Historical Trends Show Strong Stock Recovery After VIX Peaks

What has occurred in the past following peak $VIX levels? Notably, stocks have rallied 100% of the time over the subsequent 1, 2, 3, 4, and 5 years, consistently delivering returns that exceed historical averages. See chart here pic.twitter.com/dLB7ekFPJA

— Charlie Bilello (@charliebilello) April 5, 2025

Here’s where it gets interesting. Bilello analyzed total returns (including dividends) of the S&P 500 following the last 20 instances when the VIX ended a week at or above 45. Remarkably, the S&P 500 finished higher in all 100 observations of total returns.

Importantly, the S&P 500 did not just achieve minimal gains after these historically high VIX levels. Average total returns across these 20 instances were impressive:

- 39% return one year later.

- 60% return two years later.

- 63% return three years later.

- 95% return four years later.

- 139% return five years later.

Each of these results is significantly higher than the average annual total return during periods when the VIX was at lower levels since 1990.

While investing on Wall Street is never risk-free, the evidence of 100 out of 100 instances certainly suggests that acquiring high-quality stocks during market turmoil and heightened volatility is a strategic approach to building long-term wealth.

Should You Invest $1,000 in the CBOE S&P 500 Volatility Index Now?

Before purchasing stock in the CBOE S&P 500 Volatility Index, consider this:

The Motley Fool Stock Advisor analyst team has identified the 10 best stocks for investors to buy currently—and the CBOE S&P 500 Volatility Index wasn’t included. These selected stocks are poised for substantial potential returns in the future.

For example, when Netflix was included in this list on December 17, 2004, an investment of $1,000 would have grown to $496,779! Similarly, Nvidia made the list on April 15, 2005, leading to an investment of $1,000 becoming $659,306!

Notably, Stock Advisor boasts a total average return of 787%, significantly outperforming 152 % for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of April 10, 2025

Sean Williams has no stake in any of the stocks mentioned. The Motley Fool has no position in any of the stocks referenced. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.