Jack in the Box has sold its Del Taco brand for $115 million, a significant loss compared to the $575 million paid in 2022. The sale comes amidst declining traffic and a challenging financial forecast, as the company implements a block closure program, aiming to shut down 150-200 underperforming restaurants. In the most recent quarter, same-store sales for Jack in the Box declined by 7.4%, reflecting ongoing consumer downturn and heightened costs from labor, commodities, and utilities.

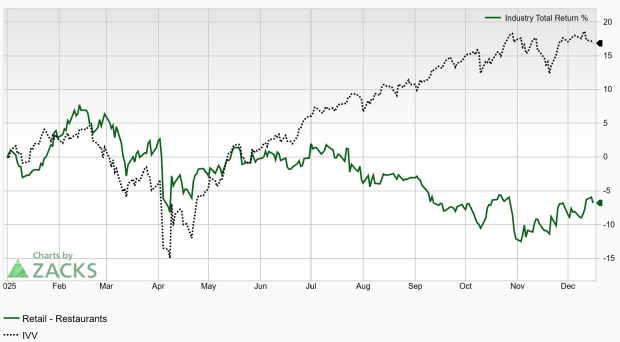

The company’s stock, classified as a Zacks Rank #5 (Strong Sell), has dropped over 50% this year and hit a 52-week low last month. Following consistent earnings misses—two out of the last three quarters—the current fiscal Q1 earnings per share estimate has been revised down by nearly 21%, indicating a potential negative growth of 41.15% from the same period last year. Investors are cautioned to reconsider their positions as the company faces increasing pressures with no immediate sign of recovery.