Toll Brothers Set to Release Q4 Earnings: What to Expect

Toll Brothers, Inc. TOL is set to announce its fourth-quarter fiscal 2024 results on December 9, following the market close.

Get ready for quarterly updates: Check the Zacks Earnings Calendar.

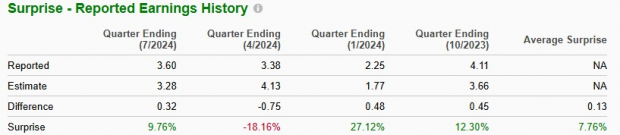

Looking Back: Recent Performance Highlights

In the last quarter, Toll Brothers achieved earnings per share (EPS) of $3.60, reflecting a 3.5% decrease year-over-year. However, this surpassed the Zacks Consensus Estimate by 9.8%. Overall revenues reached $2.73 billion, marking a 1.5% increase compared to the previous year and exceeding expectations by 1.2%. The company sold 2,814 homes at an average price of $968,000, leading to a record fiscal third-quarter revenue of $2.72 billion from home sales. Additionally, the adjusted gross margin was 28.8%, surpassing guidance by 110 basis points, thanks to improved efficiencies in homebuilding and a favorable product mix.

During the earnings call, this luxury homebuilder raised its full-year delivery forecast, now expecting to deliver between 10,650 and 10,750 homes, with anticipated homebuilding revenue in the range of $10.4 billion to $10.5 billion.

Setting the Stage: Earnings Estimates

The Zacks Consensus Estimate for the upcoming fiscal fourth-quarter EPS has increased slightly, now at $4.31, signaling a projected 4.9% growth from the same quarter last year. Revenue estimates stand at $3.16 billion, suggesting a 4.6% year-over-year increase.

Current Expectations: Zacks Model Analysis

According to our model, Toll Brothers may not meet earnings expectations this quarter. For a potential earnings beat, a stock must show a positive Earnings ESP and have a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold). However, that is not the case this time.

Earnings ESP: TOL currently has an Earnings ESP of 0.00%. To discover the best stocks to buy or sell before earnings announcements, check our Earnings ESP Filter.

Zacks Rank: Toll Brothers holds a Zacks Rank of #3. For a complete list of Zacks #1 Rank stocks, click here.

Key Factors for Q4: What to Watch

Toll Brothers is expected to see a year-over-year increase in home sales for the fiscal fourth quarter due to higher deliveries. While rising mortgage rates may impact sales volumes, the company is focused on operational efficiencies, strong demand in various regions, and an increasing inventory of speculative homes. They are also well-positioned to address long-term demographic shifts and the ongoing housing supply shortage.

The company’s emphasis on luxury buyers looking to upgrade homes is expected to boost revenue. Additionally, broadening product lines and geographical reach, along with speculative sales, have been beneficial.

During the fiscal third-quarter earnings call, Toll Brothers stated it anticipates delivering between 3,275 and 3,375 homes in the fourth quarter, up from 2,755 homes delivered in the same period last year, with an average price declining from $1,071,500 a year ago to a range of $940,000 to $950,000.

However, rising costs for land, labor, and materials, as well as increased incentives, are projected to pressure margins. The adjusted gross margin for home sales is expected to be around 27.5%, down from 29.1% in the previous year. SG&A expenses are estimated at 8.6% of home sales revenues, up from 8.2% last year. The effective tax rate is anticipated to be approximately 26%.

Our Predictions for Toll Brothers

According to our estimates, home sales revenues are projected to grow by 6.1% year over year to $3.13 billion, driven by a 20.5% increase in home deliveries to 3,321 units. The average selling price is expected to decrease by 12% from last year to approximately $943,100.

We anticipate net signed contracts of around 2,693 units, which would represent a 32.2% increase compared to last year. Furthermore, our model predicts a backlog of 6,141 units, showing a 6.6% decline from the year-ago period, while the backlog value is estimated at $6.52 billion, down 6.1% from $6.95 billion at the end of fiscal 2023.

TOL Stock: Performance and Valuation Insights

Over the past six months, Toll Brothers stock has risen and has outperformed the Zacks Building Products – Home Builders industry.

TOL’s 6-Month Price Performance

Image Source: Zacks Investment Research

Evaluating TOL’s current stock value, it trades in line with industry averages. Despite outperforming, TOL remains reasonably valued compared to larger competitors like D.R. Horton, Inc. DHI, Lennar Corporation LEN, and NVR, Inc. NVR, which are trading with forward 12-month P/E multiples of 11.01, 11.61, and 16.94, respectively. Currently, TOL boasts a Value Score of B.

Image Source: Zacks Investment Research

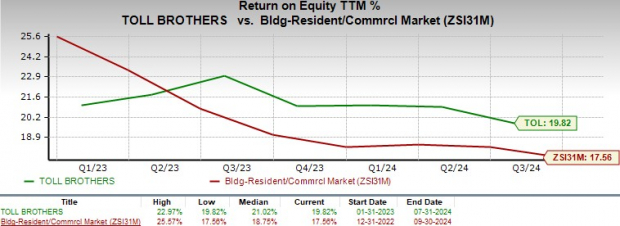

TOL’s trailing 12-month return on equity also exceeds the industry average, as shown in the chart below.

Image Source: Zacks Investment Research

Should You Buy, Sell, or Hold Toll Brothers Stock?

Toll Brothers is making a solid case for itself as a worthwhile investment, even with the homebuilding industry facing some challenges. Recently, the Federal Reserve cut interest rates which led to a decline in mortgage rates—now at 6.69% for the week ended Dec. 5, down from 6.81% last week and 7.03% a year ago. This has helped increase demand for homebuying. Additionally, favorable demographics, a strong customer base, and positive earnings revisions contribute to the company’s growth prospects. Toll Brothers is also valued attractively and has outperformed its peers, making it an appealing option for those investing in the homebuilding sector.

On the downside, rising labor and material costs and a higher percentage of speculative homes in its portfolio are pressuring profit margins. While spec homes can be sold quickly, they tend to be less profitable than custom-built homes. Furthermore, the company is using incentives like rate buydowns to encourage sales, which is affecting its gross margins.

Nevertheless, Toll Brothers’ strong business fundamentals and adaptability to market changes enhance its appeal as an investment. For anyone looking to benefit from current positive trends in the housing market, TOL stock presents a balanced mix of opportunity and resilience. Existing shareholders should consider maintaining their positions in the stock.

Explore 7 Top Stocks for the Next Month

Recently released: Experts have identified 7 standout stocks from a pool of 220 Zacks Rank #1 Strong Buys. They believe these stocks are “Most Likely for Early Price Pops.”

Since 1988, this comprehensive list has consistently outperformed the market, averaging a gain of +24.1% per year. Don’t miss this chance to check out these carefully selected stocks.

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.