“`html

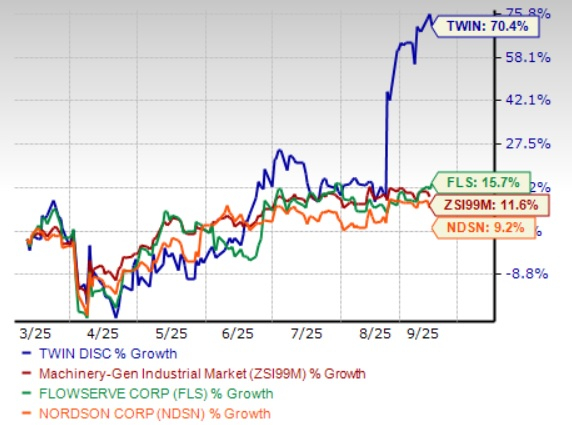

Twin Disc, Incorporated (TWIN) has experienced a significant stock surge of 70.4% over the past six months, outpacing the industry average growth of 11.6%. This growth has outperformed competitors like Flowserve Corporation (FLS) and Nordson Corporation (NDSN), which saw increases of 15.7% and 9.2%, respectively. The company attributes its success to increasing defense spending, leadership in hybrid/electric systems, strategic acquisitions, operational efficiencies, and strong free cash flow.

Founded in 1918, Twin Disc designs, manufactures, and sells marine and heavy-duty off-highway power transmission equipment, with manufacturing facilities in North America and Europe and distribution networks in the Asia-Pacific. The company capitalizes on a projected $50–75 million defense pipeline, with defense now making up about 15% of its backlog, and reported a 45% year-over-year rise in defense contributions.

Twin Disc trades at a trailing EV/sales ratio of 0.58, significantly below the industry average of 3.64, indicating potential investment opportunities. However, the company does face risks, including its dependency on cyclic marine and oil & gas sectors, high costs in the hybrid system segment, and exposure to geopolitical and currency risks.

“`