Viatris Inc. Faces Significant Challenges Amidst Market Fluctuations

Viatris Inc. (VTRS), with a market cap of $14.8 billion, stands as a major player in the global pharmaceutical sector. This company was established in 2020 through the merger of Mylan and Upjohn, a former division of Pfizer. Based in Canonsburg, Pennsylvania, Viatris is dedicated to improving access to a diverse array of medicines, including branded, generic, and over-the-counter drugs, as well as complex biologics and biosimilars. The company operates across various therapeutic areas such as cardiovascular health, infectious diseases, oncology, and central nervous system disorders.

Being categorized as a large-cap stock, Viatris benefits from its substantial market cap that surpasses $10 billion. The company’s broad product portfolio, efficient global distribution network, and significant presence in generics and biosimilars contribute to its competitive edge in the pharmaceutical industry.

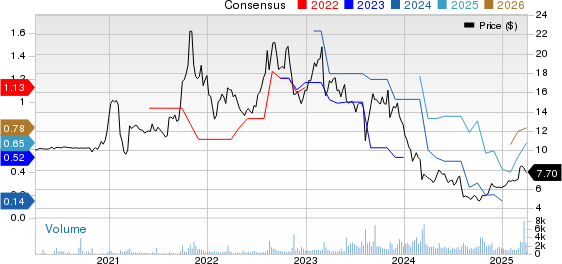

However, the outlook for VTRS is not entirely positive. The stock is currently trading nearly 35.7% lower than its 52-week high of $13.55, reached on November 23. Over the past three months, VTRS shares have declined by 30.2%, starkly contrasting with the Invesco Nasdaq Biotechnology ETF’s (IBBQ) mild drop of just 2.6% during the same period.

Extending the analysis to a yearly perspective, VTRS has fallen 27.1%, significantly trailing IBBQ’s 4.5% growth. The past six months show a similar trend, with a 24.6% drop for VTRS compared to IBBQ’s lesser 10.6% loss.

From a technical standpoint, the stock remains in a downtrend, having stayed below its 50-day moving average since early January and below its 200-day moving average since mid-January.

On February 27, Viatris released disappointing Q4 financial results, with both earnings and revenue below analyst expectations. Total revenues decreased by 8% year-over-year to $3.52 billion, falling short of the anticipated $3.62 billion. This decline stemmed from weak performances in developed and emerging markets, though Greater China showed slight growth.

Additionally, regulatory issues at its Indore, India facility are expected to cost Viatris $500 million in lost revenue and $385 million in EBITDA impact by 2025. Consequently, the company has lowered its guidance for total 2025 revenues, now projecting between $13.5 billion and $14 billion. Following the release of these disappointing earnings, VTRS’s shares dropped significantly, plummeting by 15.2%.

In comparison, Viatris has underperformed against its key rival, Perrigo Company plc (PRGO), which experienced a 12.9% decline over the past year but saw a 9.3% increase in the last six months.

Despite the turbulence, analysts remain cautious about VTRS. Among seven analysts covering the stock, the consensus rating stands at “Hold,” with a mean price target of $11.61, suggesting a potential upside of 33.3% from current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.