Analysts See Significant Upside for Vanguard Small-Cap ETF

Analyzing the ETF holdings we cover at ETF Channel, we’ve compared the trading price of each asset to the average analyst 12-month forward target price. This analysis has led us to a weighted average implied analyst target price for the Vanguard S&P Small-Cap 600 Growth ETF (Symbol: VIOG), which stands at $137.82 per unit.

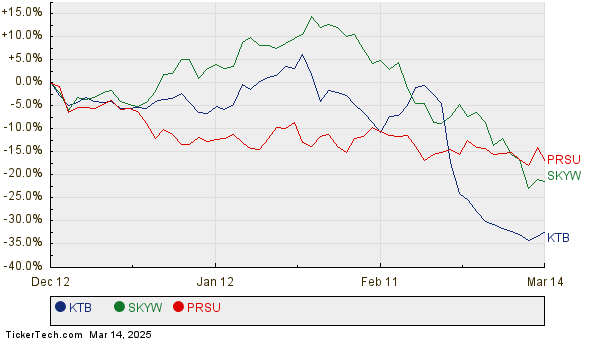

Currently, VIOG is trading at approximately $104.06 per unit, indicating that analysts anticipate a substantial upside of 32.45% based on the average target prices of its holdings. Noteworthy upside potential exists among VIOG’s underlying assets, including Kontoor Brands Inc (Symbol: KTB), SkyWest Inc. (Symbol: SKYW), and Pursuit Attractions and Hospitality Inc (Symbol: PRSU). For instance, KTB’s recent trading price at $59.51/share represents a significant 56.56% upside to the average analyst target of $93.17/share. Likewise, SKYW shows a potential increase of 53.52% from its recent price of $83.90, with an analyst target of $128.80/share. Analysts expect PRSU to climb to $52.50/share, reflecting a 39.55% upside over its current price of $37.62. Below, you can see a twelve-month price history chart comparing the stock performance of KTB, SKYW, and PRSU:

Here’s a summary table showcasing the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P Small-Cap 600 Growth ETF | VIOG | $104.06 | $137.82 | 32.45% |

| Kontoor Brands Inc | KTB | $59.51 | $93.17 | 56.56% |

| SkyWest Inc. | SKYW | $83.90 | $128.80 | 53.52% |

| Pursuit Attractions and Hospitality Inc | PRSU | $37.62 | $52.50 | 39.55% |

Are analysts too optimistic with these target predictions, or are their forecasts justified based on current and future market conditions? A significant difference between high price targets and the trading price could reflect bullish sentiment. However, this also raises concerns about potential target price downgrades, as those targets might not align with current realities. Such considerations mandate further research by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• STNG shares outstanding history

• FDEF Split History

• Top Ten Hedge Funds Holding LIAB

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.