Analyzing Wall Street’s Take on Coupang: Is It a Good Investment?

Investors frequently turn to Wall Street analysts for guidance on stocks. Changes in recommendations can sway stock prices significantly. But how much should these ratings influence your decisions?

Before evaluating the reliability of these brokerage recommendations, let’s examine the insights surrounding Coupang, Inc. (CPNG).

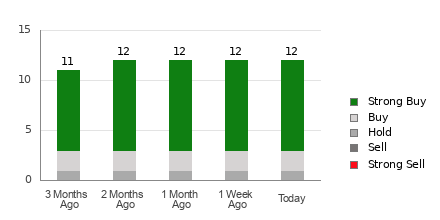

Coupang’s current average brokerage recommendation (ABR) stands at 1.29, based on a scale from 1 (Strong Buy) to 5 (Strong Sell). This figure results from the opinions of 12 brokerage firms, with 1.29 indicating a position between Strong Buy and Buy.

Out of the total recommendations, nine are classified as Strong Buy and two as Buy, which comprise 75% and 16.7% of the recommendations, respectively.

Brokerage Recommendations Insights for Coupang

Explore price targets and stock forecasts for Coupang here>>>

The ABR leans favorably towards buying Coupang, but relying solely on this information for investment decisions might not be wise. Research indicates that brokerage recommendations often fall short in identifying stocks with significant price growth potential.

Why is that the case? Analysts from brokerage firms may exhibit a strong bias toward the stocks they cover. Findings show that for every “Strong Sell” rating, there are five “Strong Buy” recommendations. Thus, brokerage interests may not align with retail investors, providing limited insight into a stock’s actual future movement.

Consequently, it might be more beneficial to use these recommendations to complement your own analysis or employ reliable forecasting tools.

One such tool is the Zacks Rank, which categorizes stocks from #1 (Strong Buy) to #5 (Strong Sell) based on a proven algorithm. This data-driven approach can enhance the accuracy of investment decisions when used alongside the ABR.

Clarifying Zacks Rank vs. ABR

Even though both the Zacks Rank and ABR are rated on a scale of 1 to 5, they measure different aspects.

The ABR relies on brokerage recommendations and may include decimals (e.g., 1.28). In contrast, the Zacks Rank uses a quantitative model focused on earnings estimate revisions and presents data as whole numbers.

Overoptimism is common among analysts at brokerage firms, often leading them to issue ratings that don’t accurately reflect market realities. This can mislead investors looking for genuine advice.

In contrast, the Zacks Rank draws from earnings estimate revisions, which empirical research has shown correlate strongly with short-term stock price movements.

Additionally, the various grades of Zacks Rank are consistently and proportionately assigned across all stocks evaluated by brokerage analysts. This ensures a balanced approach within its five ranks.

Timeliness is another critical distinction. The ABR might not always reflect recent changes, but the Zacks Rank updates quickly to signal future price movements based on evolving earnings estimates.

Should You Invest in Coupang?

In terms of earnings estimates, the Zacks Consensus Estimate for Coupang has held steady at -$0.03 over the past month.

This stability among analysts regarding the company’s earnings outlook may indicate that the stock will perform similarly to the overall market in the near term.

As a result, the recent consensus estimate, coupled with other factors, has resulted in a Zacks Rank of #3 (Hold) for Coupang. For a complete list of today’s Zacks Rank #1 (Strong Buy) stocks, see here>>>>

Investors may want to approach Coupang with cautious optimism, despite its Buy-equivalent ABR.

A Single Best Pick to Double: Expert Insight

From a vast pool of stocks, five experts at Zacks have each identified a favorite poised for over 100% growth in the coming months. Among these, Director of Research Sheraz Mian has singled out one stock with the highest potential.

This company focuses on millennial and Gen Z demographics, generating nearly $1 billion in revenue last quarter. A recent price drop could make it an opportune time for investment. Although not all selections prove successful, this one could potentially outperform previous Zacks winners like Nano-X Imaging, which surged +129.6% in under nine months.

Free: Discover Our Top Stock and 4 Alternatives

Coupang, Inc. (CPNG): Free Stock Analysis Report

For more on this article from Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.