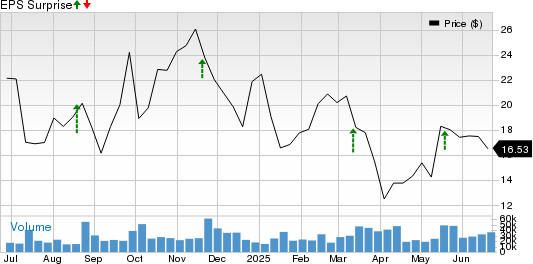

ZIM Integrated Shipping reported a strong performance with a shareholder-friendly approach, declaring a dividend of approximately $382 million ($3.17 per share) in Q4 2024 and $89 million (74 cents per share) in Q1 2025, reflecting about 30% of net income. Notably, ZIM beat the Zacks Consensus Estimate in all of the past four quarters, with an average earnings surprise of 34.5%, indicating strong operational efficiency supported by digital investments.

Frontline Plc (FRO) faces challenges including geopolitical tensions and high debt, which impact its operations and earnings estimates. The company’s debt-to-equity ratio indicates reliance on borrowed funds for fleet upgrades, and it has experienced a 4.4% average earnings miss against the Zacks Consensus Estimate. FRO’s average fleet age is 6.8 years, but ongoing uncertainties regarding freight rates and demand from China have led to downward adjustments in earnings projections for 2025.

In terms of valuation, ZIM trades at a forward sales multiple of 0.31 with a Value Score of A, whereas FRO has a forward sales multiple of 3.06 and a Value Score of C. ZIM is seen to have better prospects amid tariff uncertainties, holding a Zacks Rank #3 (Hold) compared to FRO’s Zacks Rank #4 (Sell).