ANI Pharmaceuticals ANIP is slated to report first-quarter 2024 results on May 10, before the opening bell. Investors are advised to focus on the sales performance of the company’s core business segments — rare disease and generic business.

The Zacks Consensus Estimate for the company’s earnings per share is currently pegged at 98 cents. The Zacks Consensus Estimate for total revenues is pinned at $125 million.

Let’s see how things might have shaped up for the upcoming quarterly release.

Factors to Consider

ANIP gains revenues primarily from the sales of its rare disease products, generics and established brand pharmaceutical products, royalties and other pharmaceutical services.

The company’s revenue growth in the first quarter is likely to have been primarily driven by the rapid uptake of its rare disease products, which include ANI Pharmaceuticals’ lead asset, Cortrophin Gel. Higher revenues from Cortrophin Gel are likely to have boosted the company’s top line in the to-be-reported quarter.

The drug has shown growth in the number of new unique prescribers and repeat prescribers in recent quarters, fueled by increased demandacross its initially targeted specialties of neurology, rheumatology and nephrology while gaining momentum in the newer area of pulmonology. The positive trend is expected to have continued in the first quarter.

The Zacks Consensus Estimate for ANI Pharmaceuticals’ revenues from rare disease business is pegged at $37.7 million.

Revenues from the generic and other segments are likely to have been driven by the company’s newly launched products in 2022 and 2023.

The company recently launched Levofloxacin Oral Solution, a generic version of Levaquin, in late March and Baclofen Oral Suspension, a generic version of Fleqsuvy, in early April. Sales of these newly launched generic products are expected to materially contribute to revenues in upcoming quarters.

The Zacks Consensus Estimate for revenues from generic business and established branded products is pegged at $67.8 million and $19.5 million, respectively.

Total operating expenses in the to-be-reported quarter are expected to have increased year over year, primarily due to higher selling, general and administrative expenses as a result of rising promotional activities, employment-related costs, legal expenses and patient assistance program costs.

Increased spending on research and development due to a higher level of activity associated with ongoing and new projects is likely to have spiked operating expenses in the first quarter.

Earnings Surprise History

The company’s bottom line surpassed estimates in each of the trailing four quarters, delivering an average surprise of 109.06%. In the last reported quarter, ANIP reported an earnings surprise of 25%.

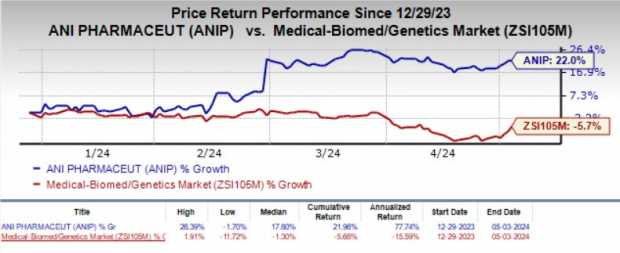

Year to date, shares of ANI Pharmaceuticals have jumped 22% against the industry’s 5.7% decline.

Image Source: Zacks Investment Research

Earnings Whispers

Our proven model predicts an earnings beat for ANIP this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is the case here, as you will see below.

Earnings ESP: ANIP has an Earnings ESP of +9.74% as the Most Accurate Estimate of $1.07 per share is higher than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: ANI Pharmaceuticals currently carries a Zacks Rank #2.

ANI Pharmaceuticals, Inc. Price and EPS Surprise

ANI Pharmaceuticals, Inc. price-eps-surprise | ANI Pharmaceuticals, Inc. Quote

Other Stocks to Consider

Here are some other stocks from the same industry that also have the right combination of elements, per our model, to beat on earnings this reporting cycle.

Adverum Biotechnologies ADVM has an Earnings ESP of +3.66% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Atara Biotherapeutics have gained 38.5% in the year-to-date period. ATRA beat estimates in three of the last four quarters and missed the same on one occasion, delivering an average earnings surprise of 3.58%.

Argenx ARGX has an Earnings ESP of +10.00% and a Zacks Rank #3 at present.

Shares of Argenx have gained 2% year to date. ARGX beat earnings estimates in two of the last four quarters and missed the mark on one occasion while meeting on the other, delivering an average surprise of 14.18%. The company is set to report first-quarter 2024 results on May 9.

Catalyst Pharmaceuticals CPRX has an Earnings ESP of +1.19% and a Zacks Rank #3 at present.

Shares of Catalyst have lost 12% year to date. CPRX beat on earnings in two of the trailing four quarters, matched once and missed in the remaining occasion, delivering an average surprise of 7.27%. CPRX is scheduled to release first-quarter 2024 results on May 8.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

Catalyst Pharmaceuticals, Inc. (CPRX) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Adverum Biotechnologies, Inc. (ADVM) : Free Stock Analysis Report

argenex SE (ARGX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.