Dutch Bros Coffee: Growth Potential Amidst Market Challenges

If you’re unsure about Dutch Bros (NYSE: BROS) stock, you’re not alone. The coffee drive-thru chain has seen significant growth that pushed its shares higher in 2024 and early 2025. However, fears about tariffs led to a downturn in February, and shares have mostly fluctuated since then.

This situation raises questions: is Dutch Bros no longer the growth stock many investors hoped for? Or is it still the growth opportunity investors anticipated, requiring patience as it navigates the market?

Dutch Bros: The Coffee Option Unlike Any Other

As of last year, Dutch Bros had just under 1,000 stores in operation. Many in the eastern U.S. may not be familiar with the brand, as it originated on the West Coast and is gradually expanding nationwide. Despite its smaller size, the company offers considerable growth potential thanks to its unique business model.

Comparing it to the industry leader, Starbucks (NASDAQ: SBUX), helps illustrate this point. For over 50 years, Starbucks has focused on creating a consistent, sit-down coffeehouse experience, whereas Dutch Bros has embraced a distinctive approach.

Unlike Starbucks, Dutch Bros operates exclusively through drive-thrus, with each location providing a unique atmosphere. Its staff, known as “broistas,” often engage with customers on a personal level, fostering a community spirit that sets it apart from competitors.

Consumer Preferences Shaping Dutch Bros’ Success

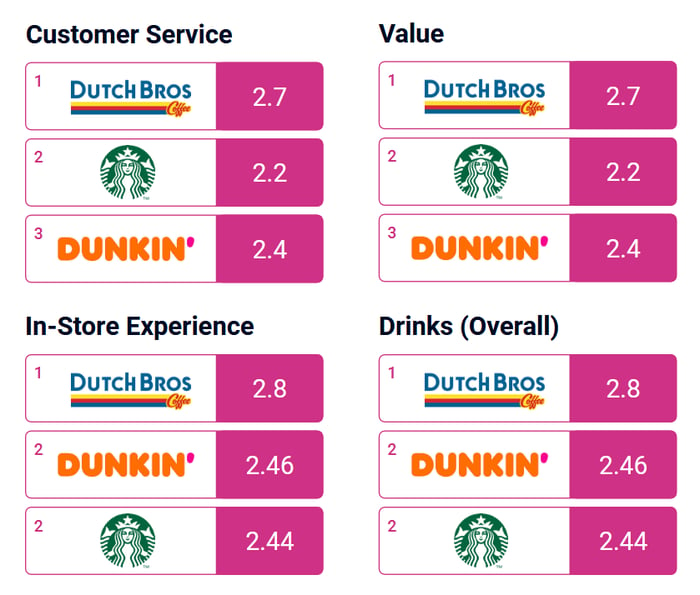

Recent data from consumer research firm Chatmeter suggests that Dutch Bros is consumers’ favorite choice for coffee and premium beverages across various metrics. A recent survey of over 1,000 U.S. adults revealed that Dutch Bros excels in customer service, value, in-store experience, and product quality compared to major competitors like Starbucks and Dunkin’ Donuts.

Notably, Dutch Bros received significantly higher ratings in these categories, particularly for customer engagement and friendliness, affirming the effectiveness of its personal interaction model in attracting customers.

Image source: Chatmeter’s Coffee Wars Analysis, published April 2025.

This growing desire for authenticity aligns with insights from digital commerce intelligence provider Nosto, indicating that 88% of consumers identify authenticity as important in their purchasing decisions, particularly post-pandemic.

Challenges Ahead for Dutch Bros

However, it’s crucial to recognize that Dutch Bros is not without its issues. Customers have reported lengthy wait times, which may stem from its drive-thru format and the prolonged interactions between broistas and patrons.

Diversifying concerns, the company is also issuing new stock to fund its growth, leading to dilution for existing shareholders. Additionally, potential new tariffs could increase ingredient sourcing costs. However, more customers generally outweigh these challenges, as the company benefits from numerous growth opportunities.

Image source: Getty Images.

While tariff effects could be tangible, coffee drinkers are typically loyal to their habits, suggesting they would likely absorb any price increases.

Looking Toward Future Growth

The data from Chatmeter strongly suggests that Dutch Bros is resonating with consumers in ways that its larger competitors do not. This is promising for its expansion efforts, which aim to grow from approximately 4,000 locations to over 7,000. Conversely, both Starbucks and Dunkin’ appear to be facing vulnerabilities in their market positions.

Dutch Bros’ projected growth trajectory may take over a decade to fulfill, yet it is expected that the stock will appreciate as the company continues its profitable journey.

In summary, while Dutch Bros may present more speculative risks compared to blue-chip stocks, its long-term growth potential remains strong. The essential queries are: how fast will it grow, and to what extent? Now may be an appropriate time to consider investing, despite unanswered questions.

Analysts are optimistic as well. Although its following is modest, twelve out of the seventeen professionals covering Dutch Bros classify it as a strong buy, despite recent stock performance challenges.

Is Dutch Bros a Smart Investment Right Now?

Before deciding to invest in Dutch Bros, keep this in mind:

Some analysts have identified other stocks as better immediate opportunities. These stocks could yield substantial returns over the next few years.

For context, consider Netflix’s performance since being recommended in December 2004. An initial investment of $1,000 would now be worth $623,685!* Similarly, an investment in Nvidia after its recommendation in April 2005 would have grown to $701,781!*

The average return of leading advisory services is 906%, significantly outperforming the S&P 500’s 164%.

*As of April 28, 2025.

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Starbucks. The Motley Fool recommends Dutch Bros. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.