ANSYS Surpasses Earnings Estimates with Strong Q3 Growth

ANSYS Inc ANSS reported third-quarter 2024 earnings of $2.58 per share, an impressive 37.2% above the Zacks Consensus Estimate. This represents an 83% increase compared to the same period last year.

Stay informed on quarterly releases: Check out the Zacks Earnings Calendar.

Total revenues reached $601.9 million, exceeding the Zacks Consensus Estimate by 13.3%. The revenue grew 31.2% year over year on both reported and constant currency bases. The growth was primarily fueled by strong multi-year lease agreements, including a notable $88 million contract in the high-tech sector in the Americas.

In January 2024, Ansys announced a definitive agreement for Synopsys to acquire the company. The deal specifies that Ansys shareholders will receive $197 in cash and 0.3450 shares of Synopsys common stock per share they hold.

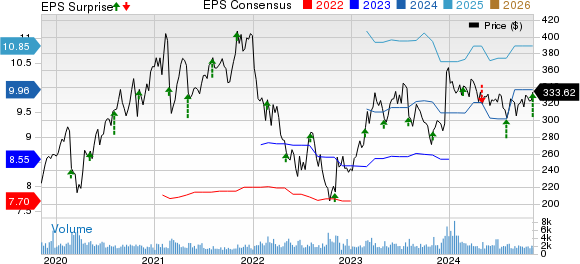

ANSYS Performance Metrics: Earnings and Estimates

ANSYS, Inc. price-consensus-eps-surprise-chart | ANSYS, Inc. Quote

Worth approximately $35 billion, this acquisition is expected to finalize in the first half of 2025. Ansys, along with Synopsys, has secured necessary foreign direct investment approvals for the transaction in most jurisdictions, including an unconditional clearance from the Israeli Competition Authority obtained on October 9, 2024.

Due to the impending acquisition, Ansys has paused quarterly earnings calls and has stopped providing financial outlooks. However, the company anticipates a double-digit growth in annual contract value (ACV) for 2024.

ANSS shares rose 1.5% in pre-market trading today. They have increased by 16.2% over the past year, while the subindustry saw a growth of 22.1% in the same period.

Detailed Breakdown of ANSYS’ Quarter

Subscription lease revenues, which make up 32.3% of total revenues, increased by 87.4% year over year on a constant currency basis, totaling $194.3 million. Additionally, revenue from perpetual licenses, composing 13.7% of the total, grew 39.9% year over year to $82.6 million.

Maintenance revenues, representing 51% of total revenues, climbed 10.5% year over year on a constant currency basis to reach $306.7 million. Service revenues, accounting for 3% of total revenues, slightly declined by 0.3% on a constant currency basis to $18.3 million.

Revenue contributions from direct and indirect channels were 74.6% and 25.4%, respectively. ACV showed a year-over-year growth of 18.1%, totaling $540.5 million, which also registered a 17.8% increase on a constant currency basis.

Regionally, revenues came from the Americas (50.9%), EMEA (22.8%), and Asia-Pacific (26.3%). Revenue from the Americas was up 40.4% year over year on a constant currency basis, amounting to $306.5 million. EMEA revenues increased by 10.7% to $137 million, while Asia-Pacific revenues rose 35% to $158.4 million.

ANSS currently has total deferred revenues and a backlog amounting to $1,463.8 million, reflecting a 21.4% year-over-year increase.

Operating Performance of ANSYS

The non-GAAP gross margin grew by 170 basis points year over year, now standing at 92.8%.

Operating expenses increased by 14.7% year over year to $371.3 million, driven mainly by higher selling, general and administrative, and research and development expenses.

Non-GAAP operating margins improved to 45.8%, compared to 34.1% reported in the same quarter of the previous year.

ANSYS’ Balance Sheet and Cash Flow Analysis

As of September 30, 2024, cash and short-term investments amounted to $1,295.3 million, up from $1,119.3 million as of June 30, 2024.

The long-term debt as of September 30, 2024, was $754.1 million, a slight increase from June 30, 2024.

During the review quarter, cash from operations was reported at $174.2 million, compared to $160.8 million in the same quarter prior.

Zacks Ratings for ANSYS

Currently, ANSS holds a Zacks Rank #3 (Hold). You can find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Comparative Performance in the Technology Sector

Seagate Technology Holdings plc STX announced first-quarter fiscal 2025 non-GAAP earnings of $1.58 per share, surpassing the Zacks Consensus Estimate by 6.8%. A year ago, the company recorded a non-GAAP loss of 22 cents per share. This turnaround was attributed to a better mix of mass-capacity products and improved pricing conditions. Non-GAAP revenues totaled $2.168 billion, beating estimates by 2.4%, with a year-over-year increase of 49% and a sequential rise of 15%. Over the past year, STX shares have gained 43.3%.

Badger Meter, Inc BMI reported earnings of $1.08 for the third quarter of 2024, exceeding the Zacks Consensus Estimate by 5.9%. Quarterly net sales amounted to $208.4 million, up 12% from $186.2 million the previous year. This growth was driven by strong yet normalizing demand for its water management solutions. Over the past year, BMI shares have increased by 57.8%.

Iridium Communications IRDM also reported earnings of 21 cents for their third quarter of 2024, which was 5% higher than expected. They suffered a loss of one cent per share in the same quarter last year. Their quarterly revenues reached $212.8 million, reflecting an 8% increase over last year, spurred by strong performance across all segments. The Zacks Consensus Estimate had been set at $205.7 million. However, IRDM shares have decreased by 19% over the past year.

Exploring Profitable Opportunities in Nuclear Energy

The demand for electricity is rising rapidly, leading to a search for alternatives to fossil fuels. Nuclear energy stands out as a strong replacement.

Leaders from the U.S. and 21 other countries have committed to tripling global nuclear energy capacities. This ambitious transition could bring significant profits for nuclear-related stocks and early investors.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, delves into key players and technologies fueling this movement, featuring three standout stocks likely to benefit the most. Download the report for free today.

Want immediate insights from Zacks Investment Research? Download our report on 5 Stocks Set to Double for free.

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Seagate Technology Holdings PLC (STX) : Free Stock Analysis Report

Iridium Communications Inc (IRDM) : Free Stock Analysis Report

ANSYS, Inc. (ANSS) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.